Does the New Tax Reform affect your Business?

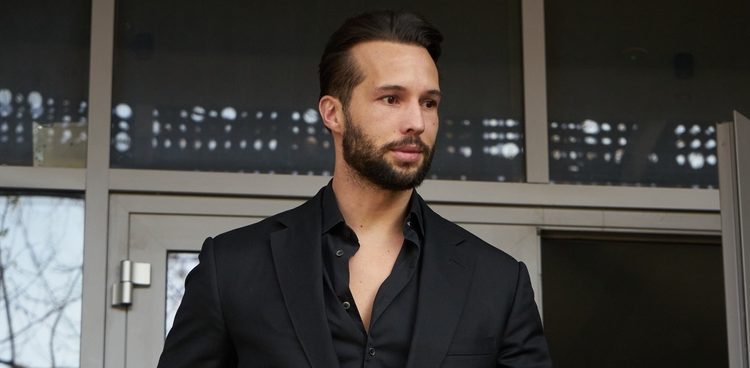

Daniel D. Morris is the Founding Partner of the Silicon Valley, Los Angeles, and Portland (Oregon) based CPA firm, Morris + D’Angelo, which focuses on servicing entrepreneurial families and their businesses. The firm utilises an integrated and holistic approach designed to help customers navigate the most complex and sensitive of matters.

Below, Daniel discusses the impact of Donald Trump’s new tax legislation, as well as the things that make Morris + D’Angelo unique when compared to other tax and business advisory firms in Silicon Valley.

What have been any recent tax policies or reforms in the US and how have they impacted your clients?

In December last year, President Donald Trump signed new tax legislation that changed the landscape of business and individual taxation. Corporate tax rates have been reduced by 40% and initiated a quasi-territorial tax system for corporations. Individual tax brackets have likewise been reduced, albeit only slightly. Individual based tax deductions have been significantly curtailed while increasing allowable standard allowances. Self-employed and associated pass-through businesses in most categories will also see reduced rates.

The most notable challenges the new legislation created are in the international arena. The new provisions created a global tax on intangibles (called GILTI) and imposes an effective 10.5% corporate level tax with the remainder excluded from income under the aforementioned quasi-territorial regime. Global structures owned and operated by individuals, families, estates, trusts, joint ventures, and pass-throughs pay a GILTI at upwards of 37% and do not receive the corporate level territorial exclusion.

This corporate versus individual disparity is creating terrific drama and challenges as advisers and taxpayers regroup their thinking as to how best to navigate global business operations while avoiding excessive taxation.

Morris + D’Angelo reacted swiftly to protect our customers’ options while providing best-of-class advisory and choices. This is an ongoing process as the legislation is so radically different in approach than the previous underlying taxation philosophy that served our country so well for nearly seventy years, that the primary concept we champion is to “hold on and prepare for more changes”.

Tell us about Morris +D’Angelo’s key priorities towards your clients? What differentiates the company as opposed to other tax and business advisory firms in Silicon Valley?

Our priorities are clearly developed around providing world-class services and options to a selected group of customers. Unlike traditional firms that charge by the hour and have a shotgun approach to customer attraction, selection, and retention, we utilise a more sniper-driven process.

Our customers share the following characteristics:

- They are closely held and family driven enterprises, meaning we do not seek publicly held companies, non-profit associations, or most regulated type enterprises.

- They are multi-jurisdictional, meaning they are or will be operating across both state and national borders and they require what we term ‘deep generalists’ that understand the complexities associated with global enterprises and who personally have developed networks of qualified advisers to assist in local matters while having a coordinated professional at the helm of global design, compliance, and outcomes.

- They frequently have family offices where we are the advisers to the family to help them achieve success in their coordinated endeavors.

- They will likely be invested in real estate as developers, landlords, commercial operators, property managers, and similar real property business activities.

- They will be engaged in technology-driven enterprises as investors, inventors, executives, and advisers.

- They will be profitable at levels that can afford our services and where there is ample cash flow to execute enhanced business operations.

- They are awesome people. They contribute to the well-being of their communities, they respect others, they promote good citizenship, and they are pleasant to spend time with. We invest in their success. Accordingly, we avoid toxic personalities.

- We live our famous trademark as we are “Not Just Another CPA Firm”.

What would you say are the challenges of providing effective tax and business advice to entrepreneurial and family-based enterprises?

Challenges, of course, are certainly situational as no two families are alike. The most common challenge is likely gathering their full attention. Entrepreneurs are doers and they are hyper-focused on achieving measurable results and rarely invest in activities that require them to reflect and ponder their futures.

Additionally, there are inherent conflicts among generations in regards to desired outcomes, where to invest the family attention, and the legacies to be fulfilled. We’re also often faced with the, unfortunately, common challenges of blended families due to divorce, or changing demographics relative to marriage and family, and the likelihood of a geographically and/or societally mixed marriage (e.g. mixed religions can create estate and inheritance issues should people of mixed faiths marry, have children, and reside in countries that base inheritance laws on religious attributes compared to for example common law or civil law countries).

On top of this, the availability of information to both the lay and professional person exponentially increases the challenge. While the internet is great for research and ideas, it fails to provide context, wisdom, or judgement. True professionalism integrates knowledge, context, and experience to blend a better result. Accordingly, there are conflicts upon perceptions of what options might be available, in the minds of customers, compared to the conclusions provided by professionals. These conflicts are best resolved by active engagement, communication, compassion, and listening. These are hallmarks of our firm. We leverage both ears before we exercise our one mouth.

What are the most tax efficient structures for US entrepreneurial and family-based enterprises?

This depends on the context of the specific case. For global enterprises, operating in a traditional cross-border CFC (controlled foreign corporation) environment, the most tax efficient structure today is likely a corporation, as it limits the global GILTI tax impact, provides for territorial tax benefits and domestic tax (on domestic earnings) of 21% or less.

For real estate type businesses, pass throughs like LLCs and Limited Partnerships are likely to provide better after tax cash flows due to reduced tax rates on real estate activities and a single layer of taxation.

As for more common business, my advice is to model out their cash flows and determine which of the available models provides the best tax-based results, ease of management and control, long-term family considerations, privacy matters, and asset protection.

I should note that trusts are generally overlooked as an operating vehicle, but they can provide many benefits of ownership along with control, asset protections, and longevity. This is something that our customers frequently consider.

How can entrepreneurs structure their business portfolio in such a way that their personal tax liability is mitigated?

Our recommendation for the families that we advise is to utilise dynastic trust concepts where the trusts are formed in excellent asset protection jurisdictions. These protector-driven trusts mitigate the risk associated with claims, allow for multi-generational transfers, and provide protection for the family’s daily operations.

What are Morris + D’Angelo’s goals moving forward?

Our goals are to continue to expand our offices to more geographies with our targets to include Dallas, Miami, Washington, DC, New York, London, and Geneva. We will continue to grow our cross-border and multinational services dedicated to helping families achieve their goals, objectives, and success. We will remain nimble, flexible, and current as it relates to technology, economics, and governance. Finally, we will continue to have fun each and every day as it makes life easier and certainly more enjoyable.

Website: https://www.cpadudes.com/

About Daniel D. Morris

In addition to his work for Morris + D’Angelo where he serves customers in over 20 countries and 25 states, Dan is also the Co-founder of The VeraSage Institute, a think tank dedicated to helping professionals improve their pricing and customer centric economics. He’s been an author/instructor with professional CPA and related associations since 1998 and has been an adjunct professor for Foothill College located in Los Altos Hills, California. Dan is the only American to hold the prestigious Post Professional Graduate Diploma in Private Wealth Advisory - a programme sponsored by the Society of Trust and Estate Professionals in the UK.

Daniel has served numerous regional and national professional associations (California CPA Society and the American Institute of Certified Public Accountants) where he’s held several leadership positions including President of the Silicon Valley/San Jose Chapter along with the state-level governance council. He is also active in FinTech, including the blockchain and associated crypto currencies and is frequently interviewed by regional and national publications.

About Morris + D’Angelo

Morris + D’Angelo’s registered trademark is Not Just Another CPA Firm – and this really is the case! The company never charges clients by time incurred, but instead, they price for purpose which ultimately means that the customers pay for the results they’ve managed to achieve.

The firm was founded in the Silicon Valley in 1994 and over the years, has helped startups and entrepreneurs that have changed the world. The team at Morris + D’Angelo listens and understands what their customers want and need and strives to deliver results in abundance. Along with the company’s physical offices, Morris + D’Angelo has a personally crafted network of affiliations throughout Europe, Asia, Australia, the Caribbean and Latin America. The firm coordinates services in a timely basis in nearly every location that deliver results that are instrumental for success.