In the latest installment of our Economics 101 Series, we discuss a term that most people will be familiar with, Trickle-Down Economics, but how much does the average man or woman in the street know about the concept of Trickle-Down Economics? Here we aim to throw light on this often-mentioned term.

When we hear the likes of ex-Prime Minister Liz Truss accused of reverting to an economic theory known as trickle-down economics, what do ‘they’ mean?

What is trickle-down economics?

In its simplest form, the broad definition of trickle-down economics is the theory that by increasing the wealth of the rich, they will spend more money, which would trickle down throughout society, leading to more wealth for all. By using measures such as de-regulation, and tax cuts for corporations or the rich, you free up more capital for those at the top of an economy to spend on investment be that in businesses which ultimately "trickles down" the economic ladder to improve circumstances for those with less money such as more jobs to be created or higher wages.

How does trickle-down theory work?

Now we've defined 'what is trickle-down economics' the theory itself is relatively simple, with the concept being that if we cut income and corporation taxes in our society and de-regulate our financial institutions, the increased wealth of these individuals and corporations would result in the rich being able to spend more of this additional money. The rich would then, in theory, invest and spend this new excess in wealth, which would, in turn, result in an increased demand for goods and services, increasing employers’ ability to recruit more staff and offer higher wages.

In this theory, the argument presented is that cutting taxes increases the incentive to work. If workers have a lower income tax, they would then be incentivised to work longer. In addition, reducing taxes such as corporation tax should encourage businesses to invest, which would, in theory, increase wealth.

Another outcome would be that the wealthy would invest in businesses, creating new jobs and more income for those employed. If the wealth is invested in new companies, it will create new jobs and increase the incomes of those employed.

As a result of the above-referenced spending and investment, it is theorised that this would stimulate economic activity, which in turn would increase tax revenues through more income tax due to the increased jobs or higher VAT due to increased spending.

These higher tax revenues could then fund public programmes such as healthcare, education, and welfare payments to the poorer in society instead of, the higher taxation that limits the richest in our society from investing.

Does trickle-down economics work?

This is mostly subjective and depends on which side of the economic spectrum you lean on. It has both its pros and its cons, and essentially, as with most things in life, it would depend on how you would be personally affected.

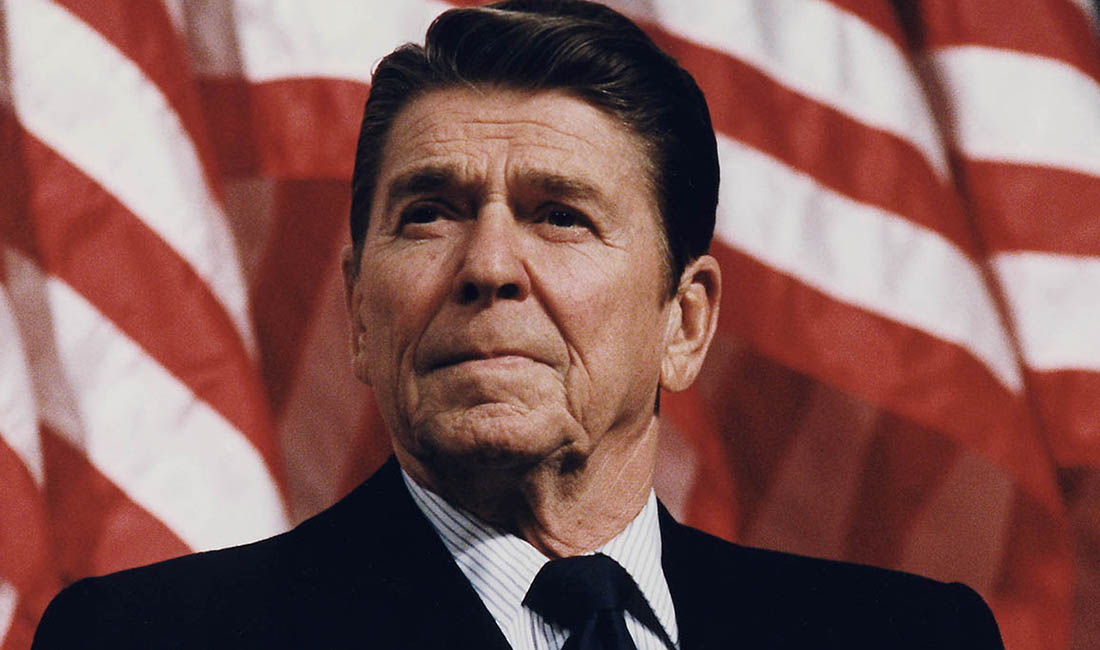

There are examples of trickle-down economics in practice. Famously, President Ronald Reagan and his “Reagonomics” became a beacon to those who believed in trickle-down economics when he passed two tax reform bills in the 1980s which brought tax down for higher earners from 73 percent to 28 percent, as well as reducing corporation tax from 46 percent to 40 percent. It is argued that as a result of this, the USA came out of recession in the 1980s and is lauded as an example of trickle-down economics working.

However, this paints only a small picture of that time, as in addition to reducing taxes, government spending increased by 2.5 percent a year, and federal debt in the USA tripled. Therefore, it is argued by its detractors that trickle-down economics in its purest form wasn’t ever implemented fully, and it could have been the increased government spending that, in fact, ended the recession.

There are further examples of this theory being put into practice, such as President Herbert Hoover’s Great Depression stimulus after the crash in 1929, Prime Minister Margaret Thatcher’s policies in the 1980s, and President George Bush’s Tax Cuts in 2001. So the theory has been tested, though some would argue not to its full extent and in its purest form.

In reality, however, one thing that becomes very apparent when this process is applied is that economic inequality increases. Suppose we use President Reagan’s and President Bush’s cuts as examples. According to trickle-down economics, Reagan’s and Bush’s tax cuts should have helped those at all income levels. But the opposite result took place: income inequality worsened. Between the years 1979 and 2005, the bottom fifth saw a 6% rise in after-tax household income. While this on its own seems great, it’s important to note that the top fifth experienced an 80% increase in after-tax household income. The income of the top 1% tripled, showing that prosperity was trickling up rather than down.

Why does economic inequality happen as a result of trickle-down economics?

In most cases of its implementation, the rich get much richer because they don’t want to invest their excess wealth. As a result, money is often stored in off-shore accounts to preserve their new wealth further. Furthermore, tax cuts for the richest in society don’t often translate to increased consumer spending, rates of employment, and government revenues in the long term. Inequality rises, and examples of the opposite system seem to work better with tax cuts for middle- and lower-income earners driving the economy through the trickle-up phenomenon.

In Conclusion

The trickle-down economics system does have its merits; however, in most practical examples, the successes are somewhat clouded due to the use of other measures to prop up trickle-down economics as a system. Therefore, it seems that as yet, we haven’t seen the theory work on its own, and with the recent failure of the Liz Truss & Kwasi Kwarteng mini-budget in the UK in October of 2022, it seems that this may continue until a severe shift in economics and public opinion can happen.

Jacob Mallinder – Finance Monthly