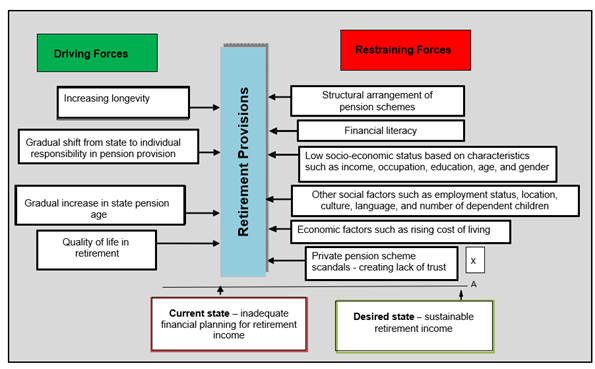

With longevity increasing in the UK, the concept of ‘retirement planning’ is becoming more important. Hence, boosting individual awareness of the need to make adequate plans for a sustainable retirement income has been a major and ongoing government policy issue. The introduction of Automatic Enrolment into workplace pensions, as a compulsory measure to enable all employers to enrol eligible workers into the scheme since 2012, has undoubtedly increased the level of awareness of the need to save towards retirement income. However, planning retirement income is often inhibited by an interplay of multidimensional factors which are often complex and dynamic. For example, income represents a crucial determinant to accessing pension schemes as well as the ability of individuals to save effectively towards retirement. Nonetheless, factors such as the rising cost of living negatively impacts on the level of disposable income from which individuals can contribute towards private pension savings. Despite the driving forces encouraging the need for a sustainable retirement income at the end of one’s working life, several barriers to the effective planning of retirement income remain (see figure below). As such, planning for an income in retirement may represent a long-term horizon for people at a younger age due to current financial priorities. Nevertheless, as old age approaches the issue of retirement income may appear more significant.

Driving and Restraining Forces of Planning Retirement Income

Adapted from Preddie (2014)

Although the main resources that are utilised as traditional strategies for promoting financial security in retirement in the UK are the state pension, occupational pensions and private pension schemes, it is acknowledged that people’s perception of the term ‘retirement’ may be derived from various factors. These include an array of factors (cultural, historical, social, emotional, political, and economic) which often influence individual preferences as well as some of the non-traditional financial provisions, such as upward intergenerational transfers, that are often adopted among various ethnic groups to ensure financial well-being in later life.