Can I get a loan with bad credit?

For those with bad credit, securing a loan can be a long battle as lenders view borrowers with a low credit score as high risk. This can often lead to stricter terms, higher interest rates or even denials. However, finding loans with reasonable terms is crucial for those with bad credit. Finding a loan with fair interest rates and manageable repayment schedules can help them cover necessary expenses without falling further into debt.

Being able to repay the loan will also provide an opportunity to improve credit scores which can then open the door to more financial opportunities in the future.

There has been a growing demand for personal loans in the US in 2024 with 93.9 million Americans currently holding personal loans.

This is a 5.3% year-on-year increase. Partly this is due to a rise in accessible loan options for those with bad credit as more lenders are offering bad-credit loans, secured loans, and alternative lending platforms. Navigating your financial choice carefully is essential to avoid high fees and dangerous lending practices.

You can take out a loan with bad credit but doing so should be carried out carefully.

What is classed as having bad credit?

Lenders will assume you are a high-risk borrower if you have a FICO score below 580. Credit scores typically range from 300-850 with higher scores indicating strong creditworthiness. Scores below 580 falls into the ‘poor’ category which then makes it challenging to secure a favorable loan.

If you miss or make your payments late on credit cards, loans or bills you will damage your credit report and could end up with a significantly lower score. High credit utilization or using a large portion of available credit will also negatively impact your score. If a borrower is unable to repay debts this will be recorded, and future lenders will be more wary.

Best loans for bad credit October 2024

When you have bad credit, finding a personal loan can be challenging, but there are several options available, including payday loans, secured loans, and loans from specialized lenders. Personal loans with a bad credit score is possible but should be carefully considered in order to avoid inescapable debt.

Payday loans

Payday loans are short-term loans designed to be repaid by your next paycheck. These loans are often marketed to borrowers with bad credit, offering quick cash with minimal application requirements. However, payday loans come with extremely high interest rates, often exceeding 400% APR, and costly fees. While they provide immediate relief, they can easily trap borrowers in a cycle of debt if not repaid on time. Payday loans should only be used as a last resort. Recent regulations in 2024 have introduced more consumer protections, limiting the amount a borrower can take and capping interest rates in some states. Still, they remain risky and should be approached with caution.

Lenders specializing in loans for bad credit

Several lenders cater specifically to individuals with low credit scores. These loans often have higher interest rates compared to those available for borrowers with good credit, but they offer better terms than payday loans. Loan amounts typically range from $1,000 to $10,000, with repayment terms usually between 12 and 60 months, depending on the lender.

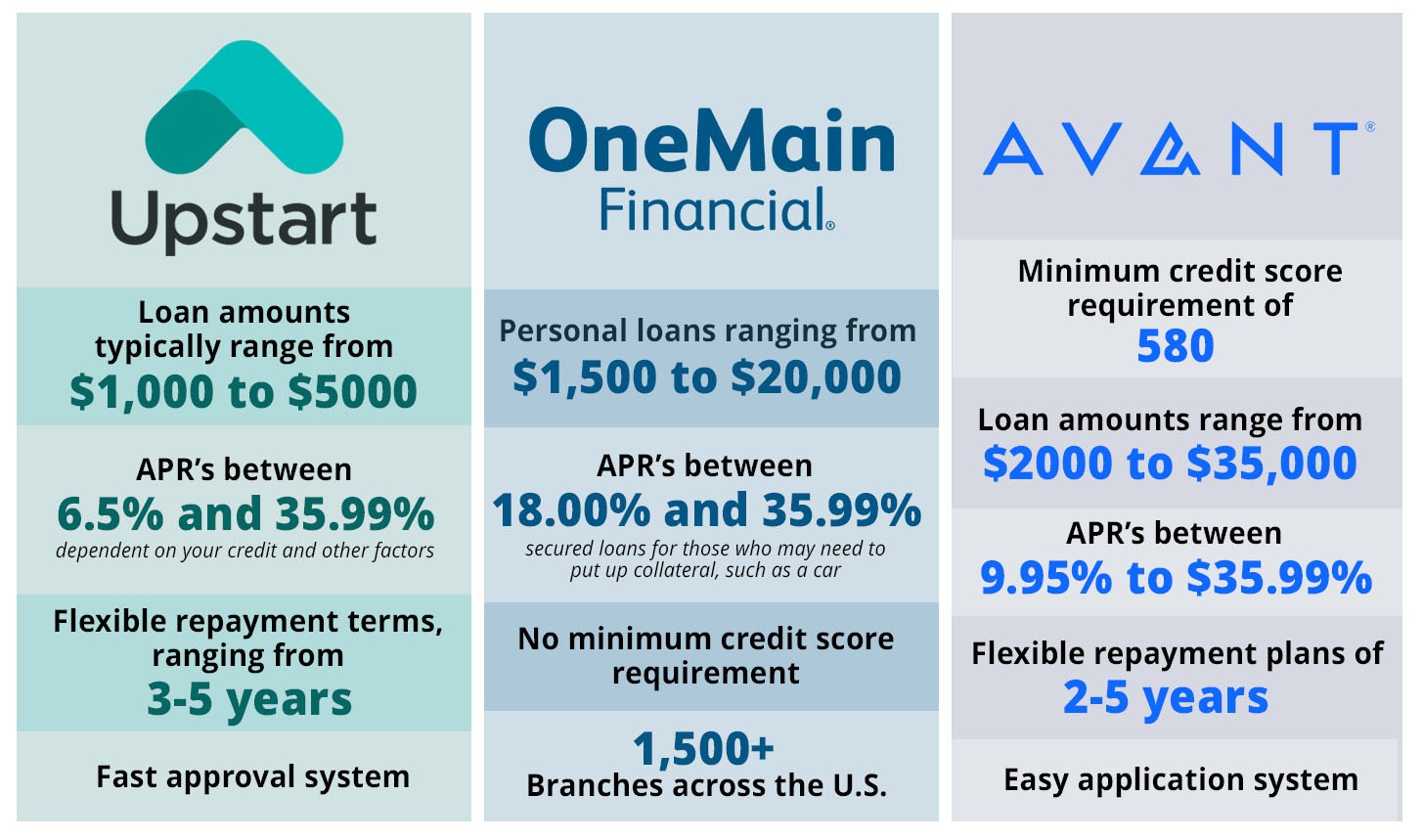

In October 2024, lenders like Upstart, OneMain Financial, and Avant continue to offer personal loans for bad credit borrowers. Upstart, for example, uses a unique model that factors in education and employment, while OneMain Financial focuses on offering personalized loan terms based on your financial situation. Avant provides flexibility with repayment and has lower credit score requirements.

Secured Loans

Secured loans are another option for borrowers with bad credit, backed by collateral such as a car or home. These loans reduce the risk for lenders, making it easier for individuals with low credit scores to get approved. Common types include car title loans or home equity loans, where the borrower’s asset is used to secure the loan. The advantage is often a lower interest rate compared to unsecured loans, but the downside is the risk of losing your asset if you default on payments.

Best loan companies for bad credit

How to choose a loan for bad credit

When choosing the best loan for bad credit, understanding key criteria can help you make a smart financial decision. Here are the factors you should evaluate:

Interest rates

This is one of the most important factors when choosing a loan. Borrowers with bad credit often face higher rates, but there can be significant differences between lenders. Look for the APR which includes both the interest rate and any other associated fees. Make sure you compare rates across multiple lenders to ensure you are getting the best offer available. The lower the interest rate, the lower your monthly payments will be, this will help you repay the loan.

Fees and Penalties

Loans often come with various fees and penalties that can add up. Watch out for origination fees, which are usually deducted from the loan amount upfront. Some lenders also impose late payment penalties or prepayment penalties for paying off your loan early. Be sure to read the fine print and ask about any additional costs. Lenders who are transparent will clearly outline all fees upfront, so avoid any that seem to hide or gloss over these charges.

Repayment terms

Some loans offer shorter terms with higher monthly payments, while others provide longer terms with lower payments but higher overall costs due to interest. Consider how flexible the repayment schedule is, and ensure it aligns with your budget. Look for options that allow early repayments without penalty, especially if you plan to improve your financial situation over time.

Approval process

Some lenders offer fast approvals with minimal checks, whereas others may conduct a thorough credit check and verification process. Being approved quickly will be tempting, however they can often come with higher interest rates and fees.

Check customer feedback and reviews

During your research it is important to take a look at past customer reviews and feedback. This will tell you how trustworthy the lenders are and whether this is a good decision for you.

Alternative to loans for bad credit

If you cannot find a loan with favorable terms and you have a bad credit score, there are some other options.

Credit builder loans

They are designed to help improve your credit while borrowing money. The lender will hold the loan amount, whilst you make regular repayments. This is a way to prove you can be a low risk, trusted borrower and in the future more lenders will accept you.

Debt consolidation loans

For those with multiple debts, a debt consolidation loan can combine them into one monthly payment, often with a lower interest rate. This simplifies repayment and can reduce overall interest costs.

Secured credit cards

You will have to provide a cash deposit as collateral, this makes them easier to obtain with bad credit.