10 Ways To Protect Your Child's Credit From Fraud

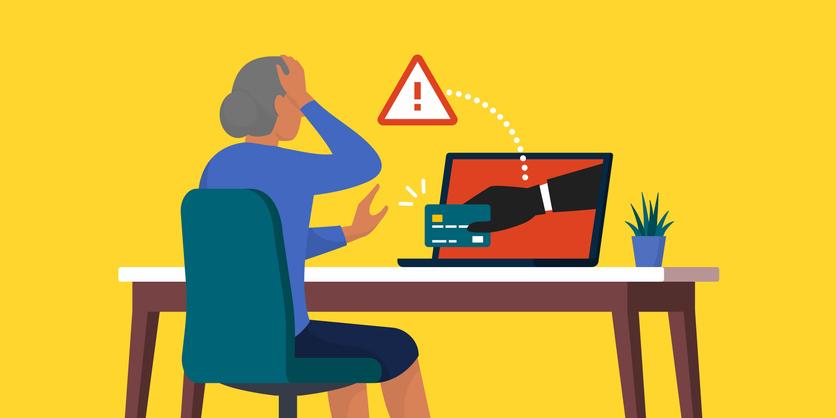

According to the Federal Trade Commission, approximately one in four households with children ages six to 17 have experienced some form of child identity fraud.

This type of fraud can lead to financial problems for your child later in life, so it's important to be on the lookout for signs that your child's credit may have been compromised. If they do fall victim to fraud, their name and information can be used to take out the best personal loan or credit cards.

If you notice unusual activity on your child's credit report, such as inquiries from companies you don't recognise or accounts that you didn't open, fraud may have occurred. You should also monitor your child's mail for bills or collection notices from creditors. If you suspect that your child's credit has been fraudulently used, you should contact the credit reporting agencies and place a fraud alert on your child's file. By taking these steps, you can help protect your child's credit and financial future.

It's important to keep an eye on your child's credit report to make sure that there is no fraud taking place. Here are a few things to look for:

1. Unusual activity. If you see something on your child's credit report that you don't recognise, it could be fraud. This can include new accounts that have been opened, charges made to existing accounts, or even inquiries from creditors.

2. Incorrect information. If any of the information on your child's credit report is incorrect, it could be a sign that someone has fraudulently obtained their personal information. This can include things like a wrong address or date of birth.

3. Poor credit history. If your child doesn't have a long credit history, you might not expect to see much on their credit report. However, if you see that they have a lot of late payments or other negative marks, it could be a sign that someone has been using their information without their knowledge.

Here are the top 10 ways to protect your child’s credit from fraud:

1. Keep your child's Social Security number and other personal information safe.

2. Check your child's credit report regularly.

3. Put fraud alerts and security freezes on your child's credit file.

4. Sign up for a credit monitoring service.

5. Teach your child about good credit habits.

6. Report any suspicious activity immediately.

7. File a police report if you suspect fraud.

8. Protect your own credit to avoid identity theft.

9. Keep tabs on your child's spending habits.

10. Talk to your child about money and credit regularly.

If you suspect that your child's credit is the victim of fraud, you should contact the credit reporting agency and the creditor immediately to dispute the inaccuracies and begin the process of restoring your child's good name.

[ymal]