SoftBank and OpenAI Launch Joint Venture for AI Services.

Japanese technology leader SoftBank Group and OpenAI are enhancing their collaboration in the field of artificial intelligence by establishing a jointly owned company, SB OpenAI Japan, with equal ownership stakes.

Japanese technology leader SoftBank Group and OpenAI have enhanced their artificial intelligence collaboration by establishing a jointly owned entity named SB OpenAI Japan.

At an event in Tokyo, SoftBank's Chief Executive Masayoshi Son and OpenAI's Chief Executive Sam Altman discussed their partnership and encouraged Japanese enterprises to participate.

Son, showcasing a gleaming blue crystal ball as a symbolic gesture, indicated that the AI service Cristal could assist companies in areas such as planning, marketing, email management, and analyzing legacy source codes.

Initially, Cristal will be implemented within SoftBank Group's own subsidiaries, which include Arm, a semiconductor and software firm, and PayPay, a digital payment platform. SoftBank has announced plans to invest $3 billion annually to facilitate the integration of Cristal across its various businesses.

“This will be super-intelligence for the company. I’m so excited,” Son told reporters and other participants at the Transforming Business through AI event.

RELATED: Sam Altman's Staggering Net Worth: Inside His Tech Empire.

Altman discussed the recently unveiled feature known as "deep research," which enables ChatGPT to perform more complex tasks, such as generating reports by searching the web and locating thousands of sources at a significantly faster rate than a human employee.

He also mentioned that deep research will be accessible in Japan in the Japanese language.

“This partnership with SoftBank will accelerate our vision for bringing transformative AI to some of the world’s most influential companies, starting with Japan,” said Altman.

SoftBank, OpenAI, and Oracle are collaborating on the Stargate project, which has received backing from President Donald Trump, with an investment of up to $500 billion aimed at enhancing artificial intelligence infrastructure in the United States.

According to Son, the Stargate initiative is set to extend its reach into Japan and other countries.

![]()

The technology industry has been disrupted by the recent revelation from the Chinese company DeepSeek, which claims to have developed highly intelligent yet affordable AI solutions.

The partnership between SoftBank and OpenAI through SB OpenAI Japan marks a significant step forward in the evolution of artificial intelligence. By integrating cutting-edge AI services like Cristal into SoftBank’s subsidiaries and other businesses, both companies are poised to drive innovation across multiple sectors, from marketing to digital payments.

RELATED: DeepSeek: The Chinese AI App Captivating the World.

The collaboration promises to enhance productivity, unlock new efficiencies, and provide transformative solutions for enterprises, particularly in Japan. With substantial investments and the addition of deep research features to AI capabilities, this venture will undoubtedly accelerate AI adoption, benefiting industries worldwide and positioning SoftBank and OpenAI as leaders in AI development.

Mark Zuckerberg’s Jaw-Dropping $220 Billion Fortune Unveiled!

What is Mark Zuckerberg's net worth and salary?

Mark Zuckerberg is a prominent American technology entrepreneur and philanthropist, with a net worth estimated at $220 billion. Over the past decade, he has consistently ranked among the wealthiest individuals globally. Notably, he is the youngest person within the top 100 richest individuals and is over a decade younger than anyone else in the top 30.

The majority of Zuckerberg's wealth is derived from his ownership of Facebook shares. He holds approximately 400 million shares of the company, distributed across various classes that confer different voting rights. Specifically, he possesses around 12 million Class A shares and 365 million Class B shares, which account for roughly 81% of all Class B shares.

Through these Class B super-voting shares, Zuckerberg maintains 53% of the voting rights within the company. Additionally, he effectively controls the Class B voting rights of co-founder Dustin Moskovitz, granting him approximately 58% of the total voting power in the organization.

Key Information

Launched thefacebook.com from his dormitory at Harvard University on February 4, 2004.

Left Harvard during his second year of study.

Rejected a $1 billion cash acquisition offer from Yahoo in July 2006 at the age of 22.

Achieved a net worth of $15 billion on the day of Facebook's initial public offering in May 2012.

Holds approximately 400 million shares of Facebook.

Exerts control over 58% of the total voting power of Facebook's equity.

Surpassed a net worth of $100 billion for the first time on August 7, 2020.

Has committed to donating 99% of his wealth during his lifetime.

Possesses around $200 million in personal real estate across the United States.

Invested $43 million to purchase the four properties adjacent to his residence in Palo Alto.

Acquired approximately 840 acres on the Hawaiian island of Kauai for $145 million.

Major Wealth Milestones

Mark achieved billionaire status on paper for the first time in 2007 when Facebook secured $240 million in investment from Microsoft, resulting in a valuation of $15 billion. Prior to this, the company's valuation had been $525 million. Following the Series C funding round with Microsoft, Mark's ownership stake was reduced to approximately 30%, making his stake worth $5 billion on paper at that time. It is important to note that the company later raised funds at a lower valuation of $10 billion in 2009. By the time of Facebook's initial public offering in 2012, Mark's stake had appreciated to a value of $15 billion.

On August 7, 2020, Mark Zuckerberg's net worth surpassed $100 billion for the first time. By late 2021, it reached a peak of $137 billion, positioning him as the third wealthiest individual globally.

RELATED: Donald Trump Net Worth. A Deep Dive into His Fortune.

As of January 1, 2022, his net worth was recorded at $126 billion, ranking him as the fifth richest person in the world. However, in the following months, Mark experienced a significant decline in wealth as Facebook's stock price plummeted by 70%, dropping from approximately $340 per share to $100. By late April, his net worth had fallen to $65 billion, a decrease of $60 billion since early January.

By late October, his net worth had further declined to $37 billion, marking a $100 billion loss compared to the previous year and an $89 billion drop since January 1. No other billionaire had experienced such a substantial loss during that timeframe, resulting in Mark's fall from the third to the thirtieth position among the world's wealthiest individuals.

Fortunately, this decline in fortune proved to be temporary. In 2023, Mark's net worth saw a significant rebound, ultimately recovering all previous losses.

On February 2, 2024, with Facebook's stock reaching an all-time high, Mark's net worth soared to $170 billion, marking the highest point he had ever achieved.

Early Life

Mark Elliot Zuckerberg was born on May 14, 1984, in White Plains, New York. His father, Edward, is a dentist, while his mother, Karen, works as a psychiatrist. He has three siblings: Randi, Donna, and Arielle. The family resided in Dobbs Ferry, New York, located in Westchester County. At the age of 12, he celebrated his Bar Mitzvah with a "Star Wars" theme.

During his middle school years, Zuckerberg developed an interest in computers and software programming. His father introduced him to BASIC Programming in the 1990s and subsequently engaged software developer David Newman for private tutoring.

Zuckerberg began his high school education at Ardsley High School, where he studied during his freshman and sophomore years. He then transferred to Phillips Exeter Academy for his junior and senior years, where he distinguished himself academically, earning awards in subjects such as physics, mathematics, astronomy, and classical studies. He served as the captain of the fencing team at Phillips Exeter Academy. While in high school, he also took a graduate-level BASIC course at Mercy College.

Additionally, he created a software application named "ZuckNet," which connected all the computers in his home to those in his father's dental office, functioning similarly to AOL's Instant Messenger, which was launched the following year. Furthermore, Zuckerberg developed a music player called the Synapse Media Player during his high school years, which adapted to the user's listening preferences. AOL expressed interest in acquiring Synapse and hiring Zuckerberg, while Microsoft also made a multi-million dollar offer for the software and sought to recruit him. However, he declined these offers and enrolled at Harvard University in the fall of 2002.

Harvard

By the time he arrived at Harvard, Zuckerberg had already established himself as a programming prodigy. He pursued studies in psychology and computer science, becoming a member of the Alpha Epsilon Pi fraternity and residing in Kirkland House. During his sophomore year, he developed CourseMatch, a program that allowed users to select classes based on the preferences of their peers and to form study groups.

Shortly thereafter, he created Facemash, a site that enabled users to choose the most attractive individual from a selection of photographs. The site generated such significant traffic that Harvard's servers were overwhelmed, leading to its shutdown by the university.

RELATED: Elon Musk's Net Worth Rockets to an Astronomical $400 Billion in 2024.

In January 2004, during the following semester, Zuckerberg began coding for a new website. On February 4, 2004, he officially launched "Thefacebook," initially accessible via the domain thefacebook.com, from his dormitory at Harvard, collaborating with classmates Dustin Moskovitz, Chris Hughes, and Eduardo Saverin.

Zuckerberg made the decision to leave Harvard during his sophomore year to focus on developing Facebook, and he was later awarded an honorary degree in 2017.

Zuckerberg, Moskovitz, and several associates relocated to Palo Alto, California, in the spring of 2004, where they rented a modest house that functioned as Facebook's office. During the summer, Zuckerberg encountered Peter Thiel, who subsequently invested in the venture. Although the group initially intended to return to Harvard, they ultimately chose to stay in California.

They had previously declined offers from major corporations interested in acquiring the company. In April 2009, Zuckerberg consulted with former Netscape CFO Peter Currie regarding financing strategies for Facebook. On July 21, 2010, Zuckerberg announced that the company had achieved a milestone of 500 million users. Today, Facebook stands as a vast social network, contributing to Mark Zuckerberg's status as one of the wealthiest individuals globally.

Legal Matters

Divya Narendra, Cameron Winklevoss, and Tyler Winklevoss, students at Harvard, initiated legal action against Zuckerberg, alleging that he deliberately misled them into believing he would assist in the development of their website concept, HarvardConnection.com, which was subsequently renamed ConnectU.

This lawsuit was the first in a series of legal challenges. The matter was resolved on June 25, 2008, culminating in a settlement that awarded them 1.2 million common shares along with cash payments totaling $20 million. If these shares are still retained, their current value exceeds $200 million. A portion of these shares was reportedly sold by the Winklevoss brothers to finance their investments in Bitcoin. By December 2017, their collective cryptocurrency holdings were valued at over $1 billion.

On April 10 and 11, 2018, Zuckerberg provided testimony before the United States Senate Committee on Commerce, Science, and Transportation concerning the handling of personal data by Facebook in connection with the Facebook–Cambridge Analytica data breach. Zuckerberg characterized the incident as a violation of trust involving Aleksandr Kogan, Cambridge Analytica, and Facebook.

Personal Life

Zuckerberg indicated that he possessed the ability to read and write in French, Hebrew, Latin, and ancient Greek when he completed his college applications.

During his sophomore year at Harvard, Zuckerberg encountered his future spouse, Priscilla Chan, a fellow student, at a fraternity gathering. Their romantic relationship commenced in 2003.

In September 2010, Zuckerberg extended an invitation to Chan, who was then pursuing her medical studies at the University of California, to reside with him in his rented home in Palo Alto. On May 19, 2012, Zuckerberg and Chan exchanged vows in a ceremony held in his backyard, which also commemorated her graduation from medical school. On December 1, 2015, Zuckerberg announced the arrival of their daughter, Maxima Chan Zuckerberg, affectionately known as "Max." They welcomed their second daughter, August, in August 2017, and in March 2023, the couple celebrated the birth of their third daughter, Aurelia.

Zuckerberg and Chan are signatories of The Giving Pledge and are actively engaged in philanthropy through their foundation, the Chan Zuckerberg Initiative. The couple has expressed their intention to ultimately contribute 99% of their Facebook shares to this Initiative.

In 2022, Zuckerberg began training in both Mixed Martial Arts and Brazilian Jiu-Jitsu. While competing at the white belt level in a BJJ tournament in May 2023, he achieved both a silver and a gold medal in gi and no gi categories. Additionally, in 2023, it was reported that Zuckerberg was pursuing his pilot's license.

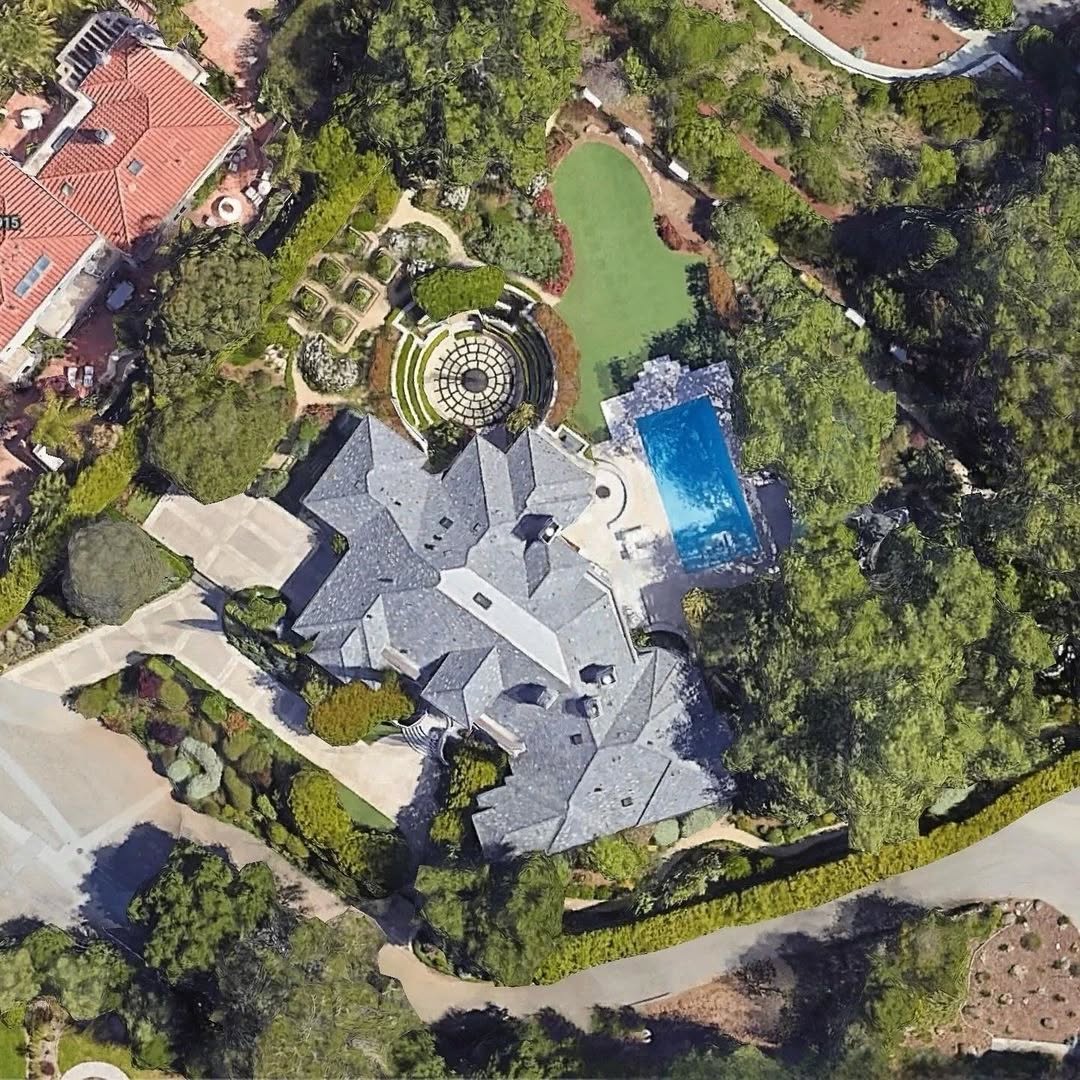

Real Estate

Zuckerberg and Chan possess approximately $200 million in real estate and land holdings globally. Among their most significant assets are 1,400 acres in Hawaii, multiple residences in Palo Alto, and a townhouse located in San Francisco.

Mark Zuckerberg's primary residence is a relatively modest 5,000-square-foot home in Palo Alto, which he acquired in 2011 for $7 million. He has also purchased the neighboring properties, thereby establishing a private compound. In 2012, Zuckerberg began acquiring the four adjacent properties, ultimately investing $43 million in these acquisitions.

He initially leased these homes back to their former owners, with plans to demolish and reconstruct them. However, city officials denied his proposal, prompting him to submit an alternative plan to renovate two of the homes and rebuild the other two as single-story residences.

In 2013, he acquired a 5,500-square-foot townhouse in San Francisco for $10 million. Constructed in 1928, this home is situated on a 9,800-square-foot lot with 70 feet of sidewalk frontage. He invested over $1.6 million in renovations for this property.

In 2014, Zuckerberg purchased two properties in Kauai, Hawaii, for $100 million, encompassing 750 acres along a secluded stretch of beach. In 2017, he added another 89 acres in the vicinity for more than $45 million. By January 2022, he expanded his holdings in Kauai to a total of 1,400 acres with the acquisition of an additional 100 acres.

In 2018, Zuckerberg invested $59 million in two adjacent private waterfront estates on Lake Tahoe, granting him ownership of 600 feet of private waterfront along the lake.

RELATED: Jeff Bezos: A Visionary Leader With a $226 Billion Net Worth.

Mark Zuckerberg’s journey from a Harvard dorm room to becoming one of the world’s wealthiest individuals is a testament to his vision, determination, and innovative spirit. His creation of Facebook revolutionized global communication, connecting billions of people and fostering a digital community. Beyond his entrepreneurial achievements, Zuckerberg’s commitment to philanthropy through the Chan Zuckerberg Initiative reflects his dedication to making a positive impact on society.

From advancing medical research to promoting education, his efforts aim to create a better future for all. With his unwavering drive and transformative contributions, Zuckerberg’s legacy continues to inspire innovation and generosity worldwide.

Sam Altman's Staggering Net Worth: Inside His Tech Empire.

What is Sam Altman's Net Worth?

Sam Altman is a prominent entrepreneur, programmer, investor, and blogger, with a net worth estimated at $2 billion. He is widely recognized for his previous roles as the president and CEO of the artificial intelligence research organization OpenAI, as well as the technology startup accelerator Y Combinator.

In his position at Y Combinator and through his personal investments, Altman has established himself as a significant angel investor, contributing to companies such as Reddit, Asana, Zenefits, Instacart, Soylent, and Airbnb. According to Reddit's pre-IPO filing in February 2024, Altman holds an 8.7% stake in the company.

RELATED: Sofia Vergara’s $180 Million Net Worth Unveiled!

Notably, it was disclosed in March 2023 that Sam Altman did not acquire any equity in OpenAI, suggesting that he did not reap substantial benefits from the company's soaring private valuation. His annual base salary as CEO is $65,000. On November 17, 2023, Altman was dismissed from his position at OpenAI, but after a tumultuous weekend filled with boardroom disputes, he was reinstated as CEO on the evening of November 21st.

Early Life and Education

Sam Altman was born on April 22, 1985, in Chicago, Illinois. He spent his formative years in St. Louis, Missouri, where he attended John Burroughs School, a prestigious college preparatory institution located in the suburb of Ladue. For his tertiary education, Altman enrolled at Stanford University to pursue a degree in computer science; however, he made the decision to leave the university in 2005.

Career Beginnings

At the young age of 19 in 2005, Altman co-founded Loopt, where he also took on the role of CEO. The company developed a geo-social networking mobile application that enabled users to selectively share their locations with others. Although Altman successfully secured over $30 million in venture capital for Loopt, the company ultimately ceased operations in 2012 due to a lack of market traction and was later acquired by Green Dot Corporation.

Y Combinator

In 2011, Altman joined Y Combinator as a part-time partner at the renowned technology startup accelerator, which has been instrumental in launching over 3,000 companies, including Airbnb, Dropbox, DoorDash, Reddit, and Twitch. By 2014, he ascended to the position of president, succeeding Paul Graham. In his initial investment round, he included his own company, Loopt.

Altman also introduced a new funding model for startups, offering $150,000 in exchange for 7% equity. In 2015, he unveiled YC Continuity, a $700 million growth-stage equity fund dedicated to investing in Y Combinator companies. That same year, he announced the establishment of Y Combinator Research, a non-profit research laboratory focused on education, basic income, urban development, and the future of computing.

In 2016, Altman declared his intention to assume the role of president of YC Group, which includes Y Combinator and its various divisions. Three years later, he shifted to the role of chairman to dedicate more attention to his other venture, OpenAI. In 2019, Geoff Ralston succeeded Altman as CEO of YC Group, and he is currently no longer affiliated with the organization.

OpenAI

In December 2015, Sam Altman, alongside Elon Musk and several other investors, announced the establishment of OpenAI, committing over $1 billion to support its operations. OpenAI consists of the for-profit entity OpenAI LP and its parent non-profit organization, OpenAI Inc., and is dedicated to conducting research in the field of artificial intelligence. The organization aims to foster and advance friendly AI that benefits all of humanity. Altman holds the position of CEO, with the company based in the Mission District of San Francisco.

OpenAI has introduced a variety of products and applications. In 2016, it launched a public beta of Gym, a platform designed for reinforcement learning research. That same year, the company also unveiled Universe, a software platform intended to train and evaluate an AI's overall intelligence across millions of websites, games, and applications worldwide. In 2020, OpenAI announced the development of GPT-3, a language model capable of generating human-like text by processing trillions of words sourced from the Internet. Additionally, it possesses the ability to translate between various languages.

On January 10, 2023, OpenAI secured funding from Microsoft in a private investment round that valued the company at $29 billion. Reports indicate that Microsoft intends to incorporate future iterations of GPT into its Bing search results.

As mentioned earlier in this article, Sam Altman did not acquire any equity in OpenAI prior to his appointment as CEO.

On November 17, 2023, Sam Altman was dismissed from OpenAI. The reasons behind the board's decision to remove him were not immediately apparent. However, just a few days later, on the evening of November 21st, Altman was reinstated as CEO.

Angel Investing

Sam Altman is a prominent figure in the realm of angel investing. His investment portfolio includes notable companies such as Airbnb, Reddit, Asana, Pinterest, Teespring, Instacart, Vicarious, Soylent, Verbling, and Stripe. Furthermore, he briefly held the position of CEO at Reddit for eight days in 2014, following Yishan Wong.

RELATED: Jeff Bezos: A Visionary Leader With a $226 Billion Net Worth.

His initial significant investment occurred in 2009 when he invested $15,000 for a 2% equity stake in the payment processing company Stripe. By mid-2024, Stripe's valuation had reached $65 billion, although by that time, his ownership percentage had decreased significantly.

Reddit Stake

In February 2024, Reddit submitted an S-1 filing in anticipation of its upcoming IPO. This document disclosed that Sam Altman possesses an 8.7% stake in Reddit, which is more than double the share held by the company's CEO, Steve Huffman.

Other Endeavors

In addition to his entrepreneurial and investment activities, Altman is the chairman of the board for nuclear energy firms Oklo and Helion. He has expressed that nuclear energy represents one of the most vital sectors for technological advancement globally.

On the philanthropic front, Altman played a crucial role in funding Project Covalence, an initiative aimed at assisting researchers in launching expedited clinical trials for COVID-19 in collaboration with the startup TrialSpark. In 2020, he also contributed $250,000 to American Bridge 21st Century, a Super-PAC supporting Joe Biden's presidential campaign.

Personal Life

Altman is openly gay, having come out during his adolescence. In 2024, he wed Australian software engineer Oliver Mulherin. Although he did not complete his undergraduate studies at Stanford, Altman was awarded an honorary degree from the University of Waterloo in 2017.

Real Estate and Automobile Collection

Sam Altman possesses a real estate portfolio valued at approximately $100 million, primarily located on the West Coast of the United States, including Hawaii. Between 2020 and 2022, he acquired properties totaling $85 million within a span of less than two years. The following is an overview of his real estate holdings:

In March 2020, Sam purchased a mansion in the Russian Hill area of San Francisco for $27 million. This property serves as his primary residence and includes a distinct "wellness center" featuring an infinity pool.

In December 2020, he acquired a 950-acre estate in Napa, California, for $15.7 million. Located just 15 minutes from downtown Napa, this estate boasts 12,000 square feet of living space distributed across five residences, two expansive private lakes, and picturesque rolling hills.

In July 2021, he invested $43 million in a 12-bedroom, 12,000 square foot oceanfront estate on the Big Island of Hawaii.

In addition to his real estate investments, Sam is recognized as a car enthusiast. He owns one of the 2,450 Tesla Roadsters ever produced, along with a 2013 Model S. Notably, his collection includes at least two McLaren vehicles, one of which is valued at over $15 million.

Sam Altman’s journey from a young entrepreneur to a pivotal figure in the tech world underscores his remarkable vision and ambition. With a net worth of $2 billion, his impact spans innovation in artificial intelligence, startup acceleration, and investments in transformative technologies.

RELATED: Nicole Kidman’s $250 Million Empire: A Star’s Journey to Wealth.

While his leadership at OpenAI and Y Combinator cemented his reputation, his career hasn’t been without challenges, including his brief removal from OpenAI in 2023. Altman’s resilience and contributions to sectors like AI, energy, and philanthropy reflect a complex legacy. As a leader and innovator, his story continues to inspire and shape the future of global technology.

Jensen Huang’s Jaw-Dropping Salary: How Much Does NVIDIA’s CEO Really Make?

What is the net worth of Jensen Huang?

Jensen Huang, a Taiwanese-American billionaire entrepreneur and electrical engineer, has a net worth estimated at $120 billion. He amassed his wealth as the co-founder and CEO of Nvidia Corporation, a technology firm known for its development of GPUs, APIs, and SoCs, among other hardware and software solutions.

From 2016 to 2023, Huang's net worth experienced significant fluctuations, increasing from approximately $3 billion to a peak of $30 billion by the end of 2021, subsequently declining to $10 billion before rising again to $20 billion. He achieved billionaire status for the first time on May 28, 2024, when Nvidia's stock valuation reached $2.8 trillion. In terms of philanthropy, Huang has made substantial contributions to his alma maters, Oregon State University and Stanford University. Nvidia Stock Holdings Currently, Jensen Huang holds 3.5% of Nvidia's total outstanding shares, in addition to 3 million vested restricted stock units.

Early Life and Education

Born as Jen-Hsun Huang on February 17, 1963, in Tainan City, Taiwan, he relocated to the United States at the age of nine, initially residing in Oneida, Kentucky. There, he attended the Oneida Baptist Institute boarding school.

Eventually, his family settled in Oregon, where he completed his education at Aloha High School in the Portland suburbs. Huang pursued higher education at Oregon State University in Corvallis, earning a degree in electrical engineering in 1984. He later enrolled in a master's program in electrical engineering at Stanford University, from which he graduated in 1992.

Stanford University

Career Beginnings

Following the completion of his master's degree in electrical engineering from Stanford in 1992, Huang took on the role of director at LSI Logic Corporation in Santa Clara. He also served as a microprocessor designer at Advanced Micro Devices, a semiconductor company based in Santa Clara.

Nvidia Corporation

In 1993, Jensen Huang, along with former Sun Microsystems engineer Chris Malachowsky and ex-Sun and IBM senior engineer and graphics chip designer Curtis Priem, established Nvidia. The trio recognized that the future of computing would be driven by graphics and anticipated that video games would play a pivotal role in this evolution. Nvidia gained prominence in 1998 with the launch of the RIVA TNT, a graphics accelerator chip for personal computers, which cemented its status as a leader in graphics technology.

Nvidia Corporation, founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, is a leading American multinational technology company headquartered in Santa Clara, California. Specializing in the design of graphics processing units (GPUs), Nvidia has significantly influenced sectors such as gaming, professional visualization, data centers, and automotive technology.

The subsequent year marked the introduction of the GeForce 256, which brought on-board transformation and lighting capabilities to consumer-level 3D hardware, coinciding with the company's initial public offering. In the early 2000s, Nvidia expanded its portfolio through significant acquisitions, including 3dfx, Exluna, MediaQ, iReady, ULI Electronics, Hybrid Graphics, and Ageia.

Nvidia is particularly distinguished for its professional GPU lineup, which finds applications across various sectors such as engineering, architecture, entertainment, manufacturing, and scientific research. The company has also developed an API known as CUDA, which enables the development of highly parallel programs that leverage GPU capabilities, widely utilized in supercomputing globally.

As Nvidia has evolved, it has increasingly ventured into mobile computing, focusing on vehicle navigation systems and mobile processors for smartphones and tablets. Furthermore, it has enhanced its footprint in the gaming sector by producing handheld consoles like the Shield Portable and launching the cloud gaming service GeForce Now. Nvidia has also emerged as a frontrunner in the field of artificial intelligence.

Philanthropy

In the realm of philanthropy, Huang made a significant contribution of $50 million to Oregon State University, his alma mater, in 2022. This funding was designated for the creation of a supercomputing institute on the university's campus. Prior to this, he had also contributed $30 million to Stanford University, another of his alma maters, to support the establishment of the Jen-Hsun Huang School of Engineering Center. Furthermore, he donated $2 million to the Oneida Baptist Institute, which he attended in his youth, to facilitate the construction of a new dormitory and classroom building for girls.

Honors and Awards

Huang has received numerous honors and awards in recognition of his corporate achievements and philanthropic efforts. In 2003, he was awarded the Dr. Morris Chang Exemplary Leadership Award by the Fabless Semiconductor Association. He subsequently received the Daniel J. Epstein Engineering Management Award from the University of Southern California. In 2007, he was honored with the Pioneer Business Leader Award from the Silicon Valley Education Foundation, and in 2009, he was conferred an honorary doctorate by Oregon State University.

Among his other accolades is the Robert N. Noyce Award, the highest distinction presented by the Semiconductor Industry Association. In 2021, he was named one of Time magazine's 100 most influential people in the world.

Personal Life & Real Estate

Huang is married to Lori, whom he initially encountered while they were both engineering lab partners at Oregon State University. Together, they have two children. Shortly after completing their studies at Oregon State, Jensen and Lori purchased a 1,500 square foot residence in San Jose, California. They sold this property in 1988 for $185,000. In the same year, they acquired a new home in San Jose for $338,000. In 1999, coinciding with NVIDIA's public offering, the Huangs sold their home for $500,000 in 2002. In 2003, the Huangs invested $6.9 million in a newly constructed 7,000 square foot mansion located in Los Altos Hills, California. They still own this property, which serves as their primary residence in California.

In 2004, the Huangs acquired an 8,000 square foot mansion located in a gated community in Maui for a sum of $7.5 million. Subsequently, in 2017, they purchased a newly-built mansion in San Francisco, which spans 11,400 square feet, for a total of $37 million. Jensen Huang’s journey from a young immigrant to the visionary leader of Nvidia highlights the transformative power of innovation and determination.

His pioneering contributions have not only reshaped the tech industry but also positioned Nvidia as a global leader in GPUs and AI. Beyond his professional achievements, Huang’s philanthropic efforts demonstrate his commitment to giving back, leaving a lasting legacy in education and technology. With a remarkable career and net worth reflecting his impact, Huang continues to influence the future of computing and inspire generations of entrepreneurs worldwide.

Nevertheless, the task of finding the platform to launch your business can be quite overwhelming. This is where Shopify excels, providing entrepreneurs with a user-friendly experience and various innovative features. One such feature that has gained popularity is Shopify’s print-on-demand (POD) service. Let’s explore what distinguishes Shopify in the POD industry.

Understanding Shopify’s print-on-demand

Printing on demand represents a business model that empowers entrepreneurs to create and sell products without inventory management. Instead, products are shipped directly to customers upon order placement. Shopify’s print-on-demand service seamlessly integrates this model into stores.

Unmatched Integration Capabilities

A critical factor differentiating Shopify’s print-on-demand offering lies in its integration capabilities. Unlike platforms requiring external integration services to connect with POD providers, Shopify offers built-in integrations with leading POD apps. This enables merchants to synchronize their stores with POD providers effortlessly, thereby streamlining their operations.

The POD apps on Shopify’s platform are exceptional, showcasing their commitment to providing the experience for merchants. Unlike platforms with fewer options, Shopify offers a wide range of top-notch POD apps, each with unique features and advantages.

Quality Printing and Finishing Options

Printing and finishing quality is crucial in the POD industry, and Shopify understands this well. That's why they have partnered with POD providers who excel in delivering printing capabilities. This ensures that every product sold through Shopify’s POD service meets or exceeds customer expectations in terms of quality.

The integration with printing-on-demand (POD) providers enables merchants to access a range of printing techniques, such as direct-to-garment (DTG) printing, dye sublimation, and screen printing. This flexibility ensures that merchants can offer customers a selection of products featuring high-quality prints.

Advanced Order and Inventory Management

Managing orders and inventory can be a task for e-commerce businesses. However, Shopify’s print-on-demand service simplifies this process through its order and inventory management features.

The order details are seamlessly transmitted to the chosen POD app whenever an order is placed on a Shopify store. The app then takes care of fulfilling the order and handling shipping. This automation saves merchants time and effort, allowing them to focus on growing their business.

In addition to streamlining the ordering process, Shopify’s POD service keeps track of inventory levels in time. This ensures that merchants are always aware of stock availability. Customer satisfaction is maintained by preventing overselling and avoiding situations where orders need to be cancelled due to stock or backorders.

Fast and Reliable Order Fulfilment Service

When it comes to meeting customer expectations in e-commerce, reliable order fulfilment is crucial. Fortunately, Shopify’s POD service excels in this aspect through its integration with top-tier POD providers.

The printing apps offered on Shopify utilize their network of printing facilities and logistics partners, enabling order fulfilment regardless of the merchant or customer's location. By partnering with print providers, merchants can reduce shipping times and costs by providing a customer experience.

Outstanding Customer Support

Running a business can be challenging for new entrepreneurs. To address this, Shopify provides customer support through live chat, email, and phone support. Whether merchants need assistance setting up their store, integrating a printing app, or resolving issues, Shopify’s support team is readily available to help.

Moreover, many of the printing apps on Shopify also offer support to their users. This ensures that merchants have access to expert guidance and troubleshooting whenever required.

Conclusion

Shopify’s print-on-demand innovation has revolutionized the e-commerce industry by simplifying the process of launching businesses for entrepreneurs. With its integration capabilities, quality printing and finishing options, advanced order and inventory management features, fast and reliable order fulfilment services, and exceptional customer support, Shopify stands out from other platforms in the print-on-demand market.

By utilizing Shopify’s print-on-demand service, business owners can concentrate on developing designs and expanding their ventures while entrusting the responsibilities of printing order fulfilment and customer support to professionals. Begin your path with Shopify now and become part of the flourishing community of POD businesses.

Securing the Financial Future

Insights from IBM on Battling Cyber Threats in an Evolving Landscape

Corey Hamilton

Global Financial Services Leader & Partner, IBM Security Services

As the Global Financial Services Leader at IBM Security Services, could you share your insights on cybersecurity in the financial industry?

The financial services sector is undergoing a period of prolonged and far-reaching change – a digital transformation that has been in progress for some time but which was accelerated by the pandemic. The wide-spread adoption of hybrid working, often supported by the implementation of cloud-based systems, reduced or constricted budgets, daunting technical debt are just some of the more obvious developments; adaptations that are uncovering new vulnerabilities and opening up new routes of attack for cybercriminals and hostile states.

In recent years, we have seen increased cyber threats targeting the financial sector, including state-sponsored threats. What are some emerging trends or techniques that cybercriminals employ, and how can financial institutions stay ahead of these threats?

One of the most worrying trends is the rise of increasingly sophisticated ransomware attacks. The days of simply locking someone’s data and then demanding a payment in return for the encryption key are long gone. Attackers have largely replaced that model with a more damaging two-step approach that simultaneously paralyses a target’s system while surreptitiously extracting its data.

Cybercriminals are always looking for the next development. As a result, things are about to get even more complicated: triple extortion has arrived. This takes the two-step approach and adds in ransom demands directed at a victim’s supply chain, a common source of vulnerability as the security maturity of each part of a supplier network won’t necessarily be the same.

How does IBM Security Services help financial organisations develop robust cybersecurity strategies? Are there any specific frameworks or methodologies that you follow?

The financial services sector needs to take a ‘zero trust’ approach to security – a methodology that abandons the idea that you can trust anyone as far as security is concerned. Everyone needs to be re-evaluated and re-authenticated and then given the lowest set of system privileges required for them to operate.

This approach also assumes the worst – that a breach is happening – it’s about spotting it rather than thinking, ‘I can’t see an attack, I’m therefore okay’. Zero trust argues that every organisation is under attack – it’s just a matter of how bad it might be.

Data breaches and data privacy are major concerns for financial institutions. What steps should organisations take to ensure the security of customer data and comply with regulatory requirements and avoid being hacked in the first place?

The burgeoning digitisation of the financial services industry, including the widespread adoption of hybrid cloud, has rightly attracted the attention of regulators and policy makers. As a result, financial institutions need to balance innovation with increasingly stringent compliance and security requirements. For example, the Bank of England is looking at ways to facilitate greater resilience and the adoption of cloud-based services and other new technologies – an approach that combines support for innovation with regulatory oversight.

With the rise of cloud computing and remote work, how can financial institutions effectively manage cybersecurity risks in these environments? What are some best practices for securing cloud-based systems and remote access?

Financial institutions are among the top targets for cybercriminals because of the wealth of valuable data they hold, which make them a very attractive to cybercriminals. This hasn’t gone unnoticed – businesses are waking up to the notion that standard security measures are not enough in the cloud. To keep customers and proprietary data secure and private, enterprise-grade security innovations, such as confidential computing, are essential.

Of course, security in the digital domain isn’t new; protecting internet communication with HTTPS is well established, as is the use of SSL, which was initially applied to credit card transactions but has since become ubiquitous. Confidential computing has the potential to become equally as pervasive due, in part, to the widespread adoption of cloud technology.

By ensuring that data is processed in a shielded environment confidential computing makes it possible to securely collaborate with partners without divulging proprietary information. It makes it possible for different organisations to amalgamate data sets for analysis – such as fraud detection – without getting to see each other’s information.

Artificial intelligence and machine learning are being increasingly used in cybersecurity. How is IBM incorporating these technologies into its security solutions, and what benefits do they offer regarding threat detection and prevention?

IBM Cloud for Financial Services is designed to help clients mitigate risk and accelerate cloud adoption for even their most sensitive workloads. Security controls are built into the IBM Cloud to enable financial institutions to automate their security and compliance behaviours and make it easier for clients to simplify their risk management and demonstrate regulatory observance.

The IBM X-Force Protection Platform augments our cyber security experts with AI and automation at global scale, resulting in more effective, efficient and resilient security operations. We have successfully helped clients proactively identify, protect, detect, respond and recover faster from attacks due to the unique capabilities of the platform. Our platform’s AI is used on top of what vendors provide within their off-the-shelf tools. The platform learns and incorporates the intelligence from 100s of analysts across thousands of our clients. It provides guidance on policy recommendations and reduces the noise, so critical items can be addressed immediately.

The services platform promotes effective, efficient, and resilient security operations, at global scale, connecting workflows across our different services. It provides a method for integrating all of an organization’s security technologies cohesively within our open ecosystem. What this means is that the services platform is IBM’s end-to-end integrated approach to Security Services. This includes a combination of software, services and methodologies which are integrated in a centralized platform providing the clients with a unified experience. IBM’s services platform integrates across people, processes and tools using open standards and best practices.

Looking ahead, what do you see as the future of cybersecurity in the financial industry? Are there any emerging technologies or trends that will significantly impact how financial institutions approach cybersecurity?

Highly regulated industries are feeling pressure to transform with an ever-increasing rate and pace. However, they must not lose focus on security, resiliency and compliance on their mission to modernise. This is especially important for financial services where regulations are rapidly changing and exposure to cyber threats has escalated to unprecedented levels. And it’s about to get even more complex.

Financial institutions need AI tools that are accurate, scalable and adaptable can keep up with the evolving threat landscape. IBM has been a leader in the work of foundation models – and watsonx is part of IBM’s push to put state-of-the-art foundation models in the hands of businesses. Furthermore, IBM is thinking bigger – building and applying foundation models for entirely unexplored business domains such as geospatial intelligence, code and IT operations.

Financial institutions also need to be crypto-agile in order to protect themselves from attack by quantum computers. Quantum and crypto agility can help financial institutions to improve their cybersecurity posture. The aim is to combine the performance of current processes that use classical and AI solutions in fraud management, risk management and customer experience, with that of the latest quantum technology, with the goal of achieving a quantum advantage.

This is where AI comes in. It can help cybersecurity teams by automating protection, prevention, detection and response processes. Paired with human intelligence, financial services companies can extend their visibility across a rapidly expanding digital landscape of applications and endpoints.

The rapidly changing technology landscape has made it difficult for banks and other financial institutions to move money across borders quickly, securely and efficiently. Archaic systems do not seem to have a place anymore, and financial institutions are given no choice but to evolve.

Nonetheless, with the advent of new and innovative payment solutions, cross-border payments' future looks promising. According to Juniper Research, B2B cross-border payments are expected to exceed USD 42.7 trillion by 2026. This growth is being driven by several factors that we will explore today.

Trends Reshaping Cross-Border Payments

1. Emerging Cross-Border FinTech Solutions

Cross-border fintechs have emerged as viable alternatives to traditional banks and other financial institutions. They can offer lower fees and faster transaction times by leveraging the latest technology. In addition, many of these fintechs offer API integration, which allows businesses to seamlessly connect their cross-border payment solutions with their existing accounting and ERP systems.

They also focus on specialised fintech-based solutions designed to automate their processes, such as mass-payment solutions and multi-currency accounts, without the need to be physically present in different countries. These are the kinds of solutions that traditional banks are often unable to provide.

The Bank of England has estimated that cross-border flows will grow significantly in the coming years, from USD 150 trillion in 2017 to an estimated USD 250 billion by 2027. This growth is being driven by a number of factors, including the increasing globalisation of trade, the rise of digital commerce and the growing popularity of mobile payments. With this increase in cross-border activity, there is a growing need for efficient and cost-effective cross-border payment solutions. This is where fintechs are able to offer a competitive advantage over traditional financial institutions.

2. The Proliferation of CBDCs

Central banks worldwide are researching and experimenting with central bank digital currencies (CBDCs). The Bank of England is one of the many institutions that are looking into this new technology. They have stated that a CBDC could provide "a more efficient and resilient payments system" and help reduce business costs.

CBDCs have the potential to revolutionise cross-border payments, as they would allow businesses to make international payments using a digital currency that is backed by a central bank. This would simplify the process, improve the speed and eliminate the need for intermediaries. In addition, CBDCs could help to reduce the risk of fraud and counterfeiting associated with traditional cross-border payments, as they would be issued using blockchain technology. This would provide a secure and immutable record of all transactions.

3. Real-Time Cross-Border Payments

One of the biggest challenges with cross-border payments is the time it takes for the money to reach the recipient. This is due to the fact that banks operate on different schedules and time zones, which can cause delays. In addition, banks often have to rely on intermediaries to process these payments, which can add even more time.

This is why real-time cross-border payments are becoming more popular. These payments are processed and settled immediately, which means that the money will reach the recipient almost instantaneously. This is made possible by using technology such as blockchain and smart contracts.

Currently, there are several initiatives underway to launch real-time cross-border payment systems, including SWIFT GPI and Visa Direct.

What Does The Future Hold?

The trends discussed here are all pointing to cross-border payments becoming faster, more secure, cost-efficient and more efficient from a customer standpoint. This is good news for businesses and consumers alike.

There are, however, some challenges that need to be addressed. Firstly, the closed-loop nature of some of the new cross-border fintech solutions may limit their market power. Bech and Hancock note that, in contrast to stablecoins, cross-border fintech solutions rely much more on existing providers and infrastructures (banks and payment systems). This means they are less deep than stablecoins in terms of the closed loop they bring.

Secondly, the legal and regulatory environment for cross-border payments is complex. This is due to the fact that there are multiple jurisdictions involved. Regulations are constantly changing, and this can make it challenging for businesses to keep up to date.

Finally, data security is a key concern for businesses when making cross-border payments. This is due to the fact that sensitive data, such as financial information, is often involved.

Despite these challenges, the overall trend is positive, and it seems likely that cross-border payments will continue to become faster, easier and more efficient.

About the author: As Co-Founder at Capitalixe, Lissele Pratt helps companies in high-risk industries obtain the latest financial technology and banking solutions.

With 7+ years of experience in the financial services industry and her global perspective, the entrepreneurial-minded Lissele is a recognised expert in foreign exchange, payments and financial technology. Her entrepreneurial spirit took her from crafting her first business at the age of 16 to building a seven-figure consultancy within the space of three years.

Lissele's hard work and determination landed her a spot on the Forbes 30 under 30 finance list in 2021. You can also find her insights in popular publications like Business Leader, Fintech Futures, Fintech Times, Valiant CEO, Finextra and Thrive Global.

As a recognised thought-leader, she has over 11,000 followers on LinkedIn, with an average engagement rate of 20k views and over 1,600 subscribers on her LinkedIn newsletter.

The advent of HMRC’s Making Tax Digital (MTD) initiative has changed the way in which we process and arrange our tax affairs irrevocably. Whilst previously only businesses with a taxable turnover above £85,000 had to comply, since April of this year, all VAT-registered businesses have been subject to mandatory online MTD submissions. Soon, similar regulations will apply to Corporation Tax (CT). But what does this mean for how we submit our returns and are most companies ready?

Disconnected data

Traditionally, VAT and CT, with their widely varied deadlines, have not been connected for reporting purposes. However, this is set to change when MTD for CT arrives, as the new quarterly CT submissions will have to be sent to HMRC within days of their equivalent VAT filings. This means that it makes sense for organisations to align their VAT and CT processes more closely.

The reality remains, though, that currently most companies are simply not prepared to leverage data across multiple MTD streams. Today’s typical accounting landscape has siloes with specialists dedicated to one specific area – be it VAT or CT – with separate data and separate timescales. Unsurprisingly, this means that tax advisors can be skilled in either CT or VAT but rarely in both. As processes continue to align, this presents a challenge.

Also notable is the fact that CT filing happens twelve months after the end of the CT financial year whereas VAT fillings happen quarterly or monthly, with reporting occurring 30 working days after. Such distinct deadlines don’t have data overlap because CT uses data that has long since been checked and finalised, while VAT-related data can be subject to change during the reporting cycle. Currently, this is no major problem but the arrival of MTD for CT with its new reporting cycles will disrupt the landscape.

Changing reporting cycles

When MTD for CT arrives, there will be additional data to submit on a quarterly basis, bringing VAT and CT tax data closer than ever – with greater interaction between the two. If your company follows calendar quarter, it currently files its VAT returns on May 5th. Going forward, you will also be submitting CT returns on 30th April, making the time between submissions much shorter. Naturally, this means that data must be aligned across both processes and that the CT team will need visibility of the VAT team’s reporting and vice versa.

So how do we connect these disparate teams more closely? Firstly, we need to revamp the legacy, siloed approach to CT and VAT and instead introduce fully integrated tax teams. This will encourage a holistic, transparent view of both disciplines underpinned by a single source of truth, enabling clarity and seamless processes throughout the tax department.

Secondly, we can look to technology to provide new ways of doing business. Too many companies still depend on Excel and similar software to enable their MTD calculations even though this puts severe constraints on processes. This old-fashioned approach needs continual manual updates, with great potential for human error, risks regulatory compliance and lacks smooth integration with other financial systems. With HMRC recently issuing updated guidance on penalties relating to MTD for VAT non-compliance, the incentive to not make mistakes continues to grow.

New opportunities and added value

The time is right, therefore, for companies to evaluate the new generation of UK-specific VAT and CT applications. These are less time-consuming, integrate seamlessly with other core IT platforms such as ERP, and automatically update according to the latest regulations. Specialist software also has the potential to minimise risk, improve precision and increase control while boosting efficiency. This can help companies of all sizes to eliminate common problems, such as laborious data formatting.

Modern, best-of-breed financial systems and VAT calculation tools can also generate value beyond meeting MTD compliance requirements. They provide more precise, timely and transparent data, which enables smarter decision-making and improved business intelligence.

This consistent access to large volumes of accurate data provides clearer insight into the profit margins in different areas of your business, helping companies identify disparities. This data can also be extracted beyond the tax department to the broader business where additional value can be leveraged.

At the same time, they enable more complex calculations, such as partial exemption, helping companies potentially recover more in VAT, for example. Not only does this ensure faster results, but it also takes the monotonous number crunching out of the hands of skilled professionals who can be redeployed to more high-value tasks.

Introducing the cloud

The traditional approach to on-premise computer platforms was to get tied into lengthy, expensive partnerships with big legacy vendors, requiring significant upfront investment in both hardware and software as well as costly ongoing maintenance. This might well provide access to an extensive solutions portfolio but is not always the best tool for the job at hand.

Today, companies are increasingly turning to the cloud instead, where best-of-breed solutions can be built from an ecosystem of existing components, connected via APIs. This means you can build the specific solution you need in less time and with fewer upfront costs, paying only for what you need when you need it.

A vision for the future

By integrating tax departments across VAT and CT and migrating to new, flexible, constantly updating cloud technologies, companies can futureproof themselves for whatever comes next on the MTD journey. Furthermore, outside of HMRC regulations, many anticipate that wider EU standards will be introduced to address similar issues. With the right solution already in place, companies will be able to comply quickly and with minimal effort.

MTD for CT is set to be introduced in 2026, which may seem like the distant future, however re-evaluating your tax reporting processes, integrating data across tax teams and implementing versatile solutions today will ensure you are well ahead of the competition. Starting to make the necessary changes now means that your team will be fully integrated and efficient – having already ironed out any preliminary issues – ahead of the compliance deadline. Using all the available data in the most connected, transparent and accessible way, will ensure VAT and CT are synchronised for success.

For more information visit https://www.taxsystems.com/.

Signs Of Increasing Acceptance For Crypto

But, in March this year, Goldman Sachs became the first major US bank to trade crypto over the counter. In a historic move, the bank traded a non-deliverable option with crypto merchant bank Galaxy Digital. Also in March, President Biden signed an Executive Order named Ensuring Responsible Development of Digital Assets. In a surprise move, Senator Elizabeth Warren even told reporter Chuck Todd on Meet the Press that the US should create a central bank digital currency (CBDC), also noting that crypto will need to be regulated - to avoid repeats of events such as the subprime mortgage crisis. These steps followed JP Morgan setting a similar milestone in February, by entering the Metaverse. While up to now most of the crypto activity has been dominated by pure crypto players like Coinbase, Paxos and Grayscale, with the recent flurry of activity many previously cynical financial services decision-makers are sitting up, and wondering if there is more to this crypto thing than they originally thought possible. Some are even playing catch-up as to what crypto even is.

Crypto Caution

Nevertheless, even with Presidential engagement, cryptocurrencies are still viewed as the Wild West and, to some extent, in the current state of play, rightly so. They can certainly be dangerous for rookie investors, with new types of cryptocurrencies or tokens fluctuating wildly, from soaring highs to collapse. Even those that are more established, with Bitcoin as the prime example, are volatile assets, subject to jaw-dropping swings in value. References and preferences by famous people can impact it massively. There are also fears about security and that crypto is used to facilitate terrorism and crime.

The cryptocurrency “movement” and blockchain generally were born of striving for better – a wish for a new way to do things. And it is a technology that has huge potential for decreasing friction, improving transparency, decentralisation and, ironically, for building more trust. The way most banks still operate is no longer fit for purpose.

In the short attention span landscape we now operate in, three to five business days for funds to clear is increasingly perceived as inappropriate and unacceptable by customers and they’re increasingly unwilling to tolerate paying hefty amounts with apparently foggy fee structures for a snail’s pace service in terms of payments, international transfers and so on. It's the consumer who suffers and pays for inefficiencies that seem prehistoric in today’s fast-moving environment.

And then are those that are underbanked or entirely unbanked. Many millions of people across the globe are denied access to financial services entirely. Even in America and Europe, where there’s a bank on every corner, still today we see that without tax returns, a permanent address or access to a physical branch, gaining loans or just opening a bank account, remains difficult or entirely out of reach for many. In developing countries, the problem is far worse - huge. Cryptocurrency has the potential to address this imbalance.

However, and here we come full circle, cryptocurrencies suffer from a reputation problem, in a way that banks don’t. And crypto can’t get the buy-in it would need from the wider population outside its early-adopter fan base that it would need. Older people, in particular, are likely to baulk at using them.

Is Crypto Dangerous?

It’s not actually true that cryptocurrency is fundamentally unsafe. Its underlying technology is, in fact, far more stable and transparent than that of many mainstream banks, which themselves have some fairly unstable, outdated technology. Bitcoin, as an example, has never been hacked, while many mainstream banks have lost the data of millions and suffered breaches that have compromised the privacy of their customers. Decentralised finance holds rich promise - if it works hand in hand with more trusted financial brands and within the established systems.

The Benefits Of Crypto

While some Bitcoin pioneers don’t want banks to have any role in the financial systems of tomorrow and linked the technology to an idealistic ideology, most people just care about transaction speed: how easy that transaction is to make, that it doesn’t cost too much, and that it is safe. Banks working with cryptocurrencies can deliver that. The technology is a game-changer, but to truly deliver, it will have to integrate with mainstream banking systems.

What’s in it for banks is simple. Banks hate losing customers, especially en masse. And lots of customers are looking in the crypto direction. If customers are wealthy and want a fully diversified portfolio for the best returns on investment, they likely aren’t going to want to miss out on the crypto potential. Likewise, if bank customers want to interact in the metaverse, it can’t be done without a crypto wallet, which currently their bank isn’t offering.

If you’re working in America and sending money home to family in another country, you don’t want to be charged 20% and upwards to transfer that money. Likewise, financial institutions are paying through the nose transferring money cross-border. Each transaction can go through several different banks and different gateways using the labyrinthine and only partially-automated and costly SWIFT system. Crypto can make the process faster and exponentially cheaper. Funds can be used to buy Crypto, transferred via a digital wallet and exchanged at the other end for a different currency. It’s like the difference between queuing on the highway for the toll gate or using an electronic pass on a tag in the window - a digital highway.

How Banks Can Keep Up With Crypto

Banks will increasingly need to create and offer infrastructure for cryptocurrency so that they keep hold of clients.. Say an institutional client or wealthy client has 100 million in a bank and wants a 20 million direct exposure to crypto - right now they couldn’t do it through a mainstream bank as no banks offer that service. So that customer now would have to take their 20 million and open an account at Coinbase. Money is walking. Coinbase has a 98 million customer base - larger than that of JP Morgan, which has been in business for over 150 years.

Banks need to at the very least start offering custody, key management and digital wallets. As brands outside of banking look to transact in e-commerce, NFTs and cryptocurrency in a more efficient way, there is an opportunity for banks to enable them to set up their accounts that could also be housed at a bank.

Going forward banks may extend into crypto investment and the areas of staking, liquidity pools and Defi as they grow in size and importance to the marketplace. Crypto mortgages for the metaverse are a big opportunity for banks. Such mortgages are already available elsewhere.

Banking is becoming an ambiguous term, as many new players such as Walmart come on board. There used to be lines drawn around areas of finance. Not so long ago, asset management was doing investments and managing people's money and banks were doing payments. Fast forward to today and the lines are blurred - there's no distinction anymore. Now banks are doing asset management, investment management, and payments. Tech companies are doing payments. And Walmart is doing mortgages. And fintech is doing asset management and old established banks are doing fintech. Banks need to stay relevant.

Final Thoughts

Look at the landscape in the mid-nineties. Some said you’ll be able to make calls via the internet, and they’ll be free. But that seemed decades off. Look at contactless payments, and voice recognition. All these seemed very new one day and shortly after, just the way we do things.

Regulation is on its way and this - along with the rise of the metaverse, with its huge appeal to the mass market - will bring down the final barrier to crypto’s natural place at the heart of an evolving financial ecosystem.

Cryptocurrency will become mainstream, and sooner than many think.

About the author: David Donovan is EVP, Financial Services, Americas at Publicis Sapient.

With disconnected processes and systems within their customers’ infrastructure exacerbating the issue, it’s not surprising that many fintech solutions are difficult to fully integrate. Indeed, almost half (40%) of fintechs globally are struggling to connect to their customers’ applications or systems, according to research from InterSystems.

This challenge is likely to make it difficult for fintechs to integrate any new applications or solutions within a financial services organisation’s technology stack – impeding their ability to collaborate with these types of institutions. With 93% of all fintechs surveyed keen to collaborate with incumbent banks in some way, connectivity problems could seriously inhibit their ability to capitalise on these potentially lucrative relationships.

To avoid missing out on opportunities like these, fintechs must find a way to connect more easily to any financial services organisation’s existing legacy applications. 47% of global fintechs state that enabling better integration with customers and third parties is one of the biggest drivers behind implementing new technologies, so there is a clear appetite to address this challenge.

One of the most effective solutions for fintechs is to develop a bidirectional data gateway between their own applications - of which 98% are at least partly cloud-based, 23% are hybrid cloud and on-premises, and the remainder are based in public or private clouds - and their customers’ environments. This can be achieved with smart data fabrics. With cloud offerings making it easier to provide remote access and service updates, in addition to facilitating deployment on-premises, developing a bidirectional gateway will ensure that financial services institutions do not miss out on innovative fintech applications.

A new architectural approach

Traditionally, integration of fintech services and applications has been accomplished through manual and cumbersome means: the slow process of coding point-to-point integrations and moving and copying data is difficult to maintain and notoriously prone to errors. Moreover, this outdated practice makes feeding applications the live, real-time data they require extremely difficult.

By implementing a smart data fabric, a new architectural approach, fintechs can create a bidirectional, real-time data gateway between their cloud-based applications and their customers’ existing on-premises and cloud-based applications and data stores. The smart data fabric provides a complementary and non-disruptive layer that connects and accesses information from legacy systems and applications on-demand.

Smart data fabrics integrate real-time event and transactional data, along with historical and other data from the wide variety of back-end systems in use by financial services organisations. They can then transform it into a common, harmonised format to feed cloud fintech applications on demand, providing bidirectional, real-time, consistent, and secure data sharing between fintech applications and financial services production applications. Bidirectional connectivity also ensures that any changes made through the fintech applications can be securely reflected in those production applications.

Embracing this new architectural approach will allow financial services organisations easy leverage of new fintech services and applications, facilitating seamless integration with their existing production applications and data sources. For the 40% of fintechs currently finding it difficult to connect to their enterprise customers’ environments, this will be very gratefully received – and will open the door to mutually beneficial partnerships with banks.

Driving innovation forward

Easier integration between fintech cloud-native applications and financial services organisations’ existing infrastructures will provide banks with a consistent, accurate, real-time view of their enterprise data assets, as well as increased speed and agility. With the financial services sector in need of an innovation injection to meet changing customer and regulatory expectations, this smart data fabric-powered approach to developing a bidirectional data gateway will also help to spark creativity and fuel innovative ideas.

These capabilities will enable financial services institutions to swiftly react to new opportunities and changes in their environment. It also gives them the insight needed to make better business decisions and improve customer experience, as they can provide more digital and hyper-personalised offerings.

Fintechs across the world are recognising the potential benefits of improved collaboration with banks. 56% believe that banks will get value from fintechs through improved customer experience and engagement, while 50% say that better partnerships will result in more opportunities for banks to focus on their core areas of expertise. A similar number (54%) believe that banks stand to gain from increased agility and speed to market. With data fabrics, fintechs and banks can take steps towards putting these objectives into motion.

A win-win for fintechs

By adopting a smart data fabric approach to implementing a real-time, bidirectional data gateway, fintechs globally will effectively kill two birds with one stone – helping to increase both collaboration and innovation.

Embracing this new type of data architecture will allow fintechs to better connect their cloud-based applications to their customers’ environments, allowing solutions to be more swiftly and easily integrated within those environments. In turn, this will boost the potential for collaboration with financial services institutions.

Furthermore, this technology will enable fintechs to better support financial services organisations through their own data struggles, helping data to instead become a critical differentiator that empowers financial services to swiftly innovate. By being able to more easily adopt fintech applications, financial services organisations can unlock faster development cycles, experience fewer bugs, and even reduce their total cost of ownership. Enhanced innovation opportunities will steer institutions towards their business goals, thereby delivering benefits back to their customers and creating an all-important competitive edge.

About the author: Redmond O’Leary is Sales Manager, Ireland at InterSystems.

Finance Monthly is pleased to announce that the full list of winners of our 2021 Women in Finance Awards has been published.

Working in the financial services sector as a woman has always meant facing challenges, barriers to entry and an unequal gender balance in the workplace. Since the release of the Finance Monthly Women in Finance Awards 2020, we have seen some progress towards gender parity in the sector – however, 20% representation of women on executive committees and 23% on boards is still a far cry from our end goals and proof that a good deal of work remains to be done to ensure greater opportunity for women’s advancement in financial services.

As a leading financial publication, Finance Monthly strives to shine a light on the work of female professionals, the obstacles they face and the challenges they overcome. Each of the finance experts featured in this year’s edition of the Finance Monthly Women in Finance Awards are women who consistently achieve more than is expected of them despite barriers within the industry at large.

2021’s Featured Winners

This year’s standout winners include Susie Hillier, Head of Wealth Planning at Stonehage Fleming, who tells us about her success in building a diverse and high-performing team. We also hear from Rebecca Fels Larsson on her career progress as an investment professional at CORDET, among many other stories of achievement from female professionals.

At Finance Monthly, we are proud to share each of these stories with you. Congratulations to all our winners.

Dima Kats, CEO of Clear Junction, explains what open banking is and why businesses should care.

Open banking breaks down traditional barriers in the financial sector that kept customer data locked up. For years, the only way businesses and consumers could view financial data like transaction histories was through paper statements or web forms. The lucky ones may have been able to access data in PDFs, or perhaps as downloadable files for specific desktop programs. For most customers though, that put restrictions on how they could use that data. Open banking changed everything. It puts businesses and consumers back in control of their data, allowing them to grant direct access to third-party companies via application programming interfaces (APIs) operated by their banks.

Open banking needs data

Data access is important for fintech companies that want to enhance their own services, such as fast loan approvals or budgeting applications. An online budgeting service could use customers' transaction data to show them summaries of where they spend their money, helping them to plan their finances more effectively. Fintech also includes elements of artificial intelligence (AI), typically in the form of machine learning. The combination of access to larger amounts of financial data and the power of AI will enable businesses and consumers to glean new insights from banking services.

Initial access to that data has been difficult in the US, but on 9 July 2021, the Biden administration took a big step to support open banking's quest for data by introducing an Executive Order on Promoting Competition in the American Economy. The Order contained a series of measures covering issues ranging from the right to repair through to non-compete clauses. Among them was a request for the Consumer Financial Protection Bureau (CFPB) to consider new rules that would mandate portability for financial data. This move didn't happen in a vacuum. The CFPB had already issued non-binding guidance on open banking in 2017, followed by an advanced notice of proposed rulemaking last October that would give open banking principles regulatory teeth. Nevertheless, the Executive Order brings even more momentum to this issue.

Embracing competition

Hard rules on data portability will have a significant impact on a US banking market that has seen an erosion of competition in the last few decades, with nine in ten banks closing since 1985. Gaining access to their data will give consumers and businesses more power to switch financial institutions. It will also spark a whole new wave of innovative competition. Smaller challenger banks in the US will be able to offer services using customers’ banking data.

Ushering in a new era of open banking in the US will also encourage cooperative relationships between incumbent and new financial players. Soon, consumers and businesses will be able to make their financial data available to fintech players who can use it to offer cutting-edge services at speed and scale, often in partnership with incumbent banks or with each other. Fintech companies will be able to use APIs to exchange data with banks directly so that they can complement each others' services and provide seamless user experiences.

The Executive Order was also a clear sign that this administration wants to keep laws and regulations in sync with new technological developments. This is encouraging, as it gives more certainty to new and rapidly evolving areas of the economy. Clear rules stipulating data sharing will encourage fintech companies to invest in more exciting services.

Spreading open banking through responsible regulation

This development in the US will hopefully also stimulate competition abroad, where open banking concepts are in various stages of development. In Europe, version 2 of the Payment Services Directive (PSD2) took effect in 2018, imposing similar data portability rules. The results have been impressive. In the UK, 2.5 million UK consumers and businesses now use open banking-enabled products to handle their finances, according to the UK government's Competition and Markets Authority.