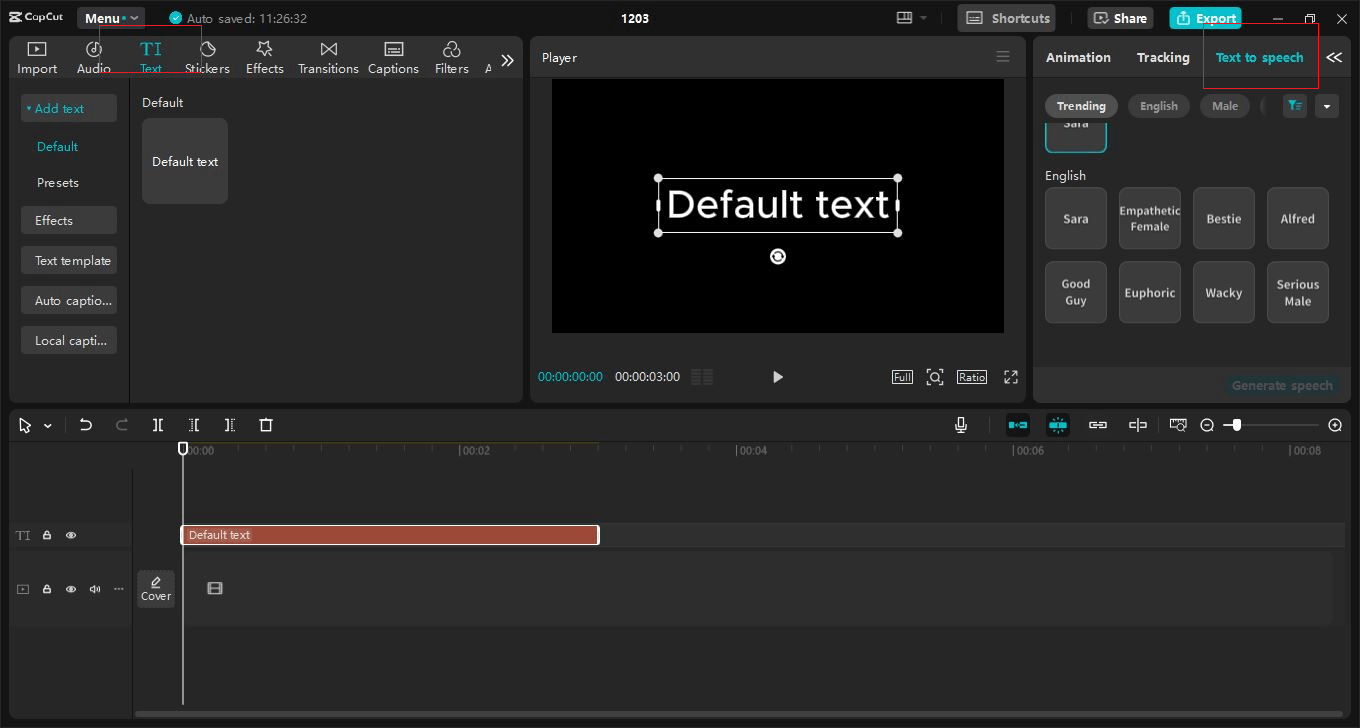

Looking for a professional narrator but worried about the cost? Or perhaps your voice cracks, and you’re not confident speaking on camera? That’s where the CapCut desktop video editor video editor comes in! You’ll be able to meticulously edit text-to-voice features, with no need to speak a word yourself. If you are creating content for YouTube, Instagram, presentations, or telling a story, CapCut provides you with several free voice-over services in various languages and intonations. Whether you’re producing videos for social media, presentations, or storytelling, CapCut offers multiple free voice narration options in different languages and tones to suit your project’s needs.

Say goodbye to hiring expensive voiceover artists or struggling to sound professional. The CapCut voiceovers section offers a simple navigation bar that helps you discover and edit the audio files for your videos within a few clicks to make them sound professional and engaging. Discover how this versatile video editing program by Capcut helps anyone achieve professional-quality voiceovers in their videos.

1. A Library of Free Voice Options for Every Tone and Language

Forget about spending hours searching for the perfect narrator. CapCut desktop video editor video editor has an extensive library of free voice-overs that are suited for any kind of video project and its tone. If you are looking for a relaxing voice for meditation, a motivational tone for product promotion, or a formal voice for a corporate video, CapCut video editor for pc is ultimately your go-to solution. The text-to-speech system is offered in multiple languages and can replicate regional accents, which would allow for a connection with your audience across the world. This freedom of voice choice is beneficial whether writing content in English, Spanish, French, or even other languages.

CapCut

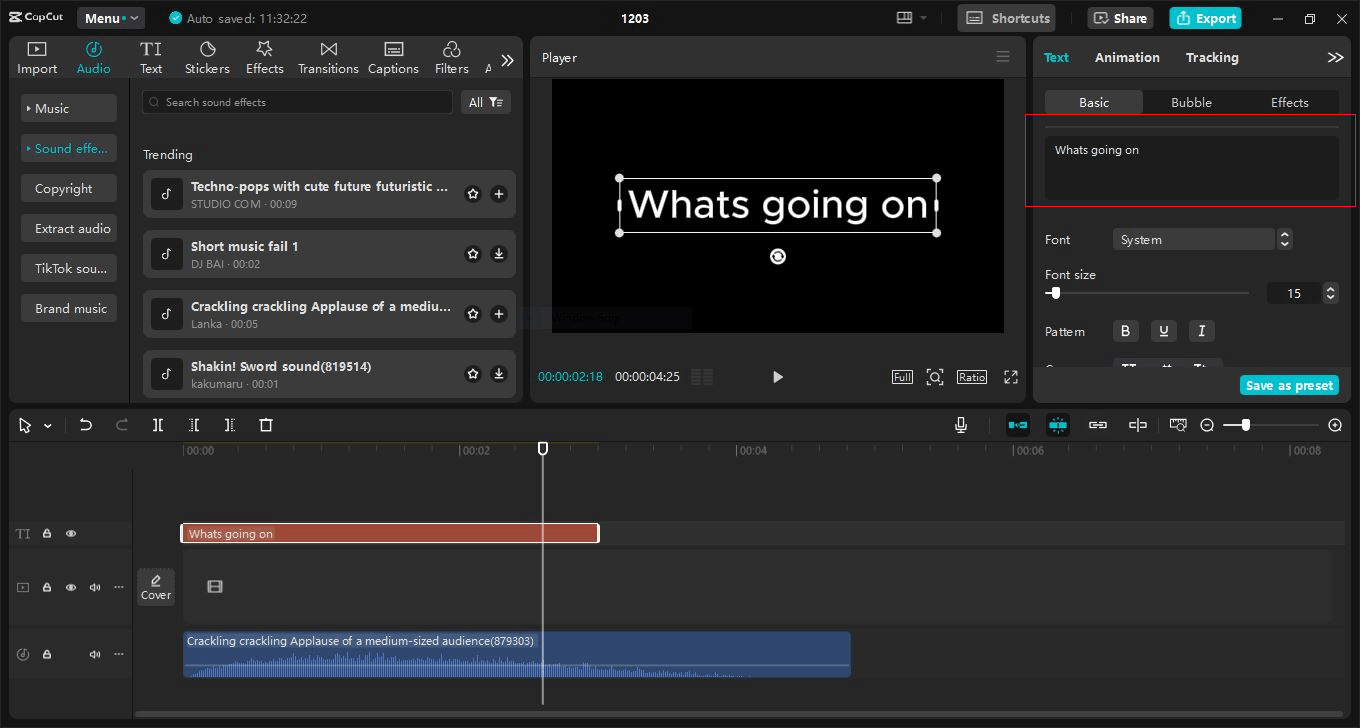

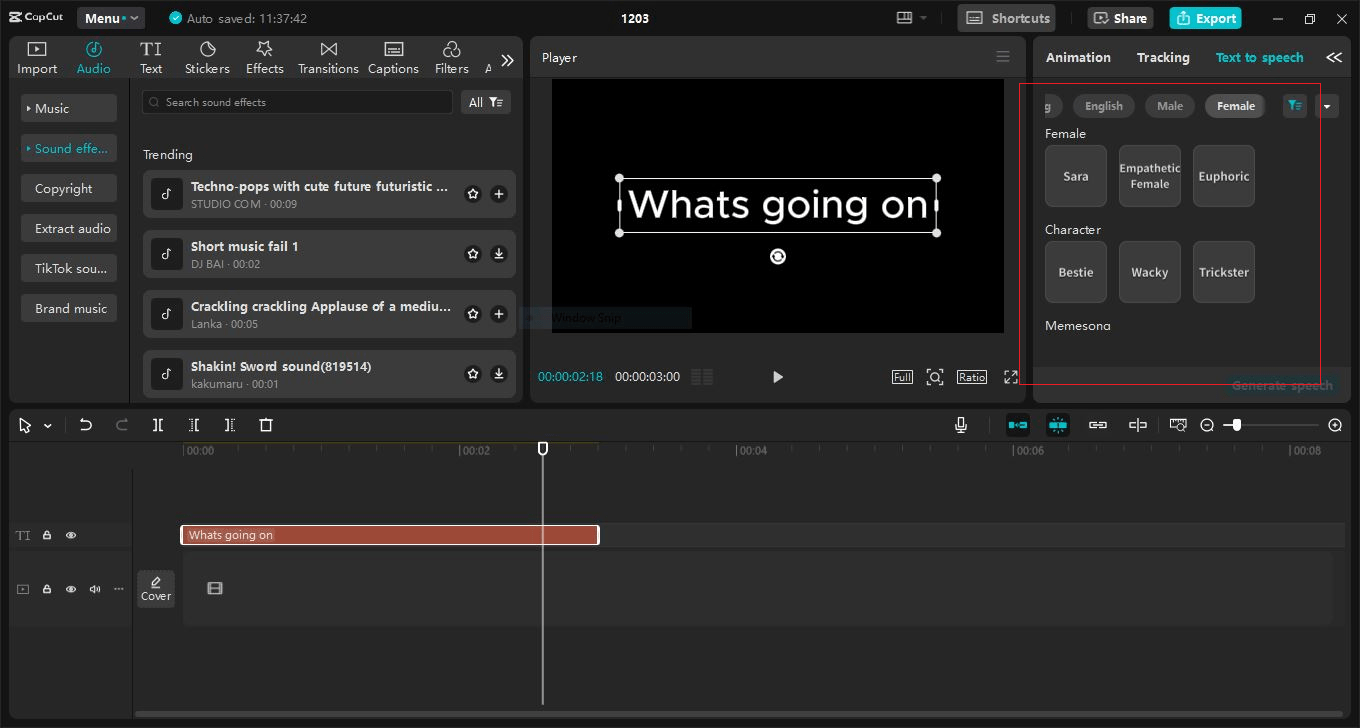

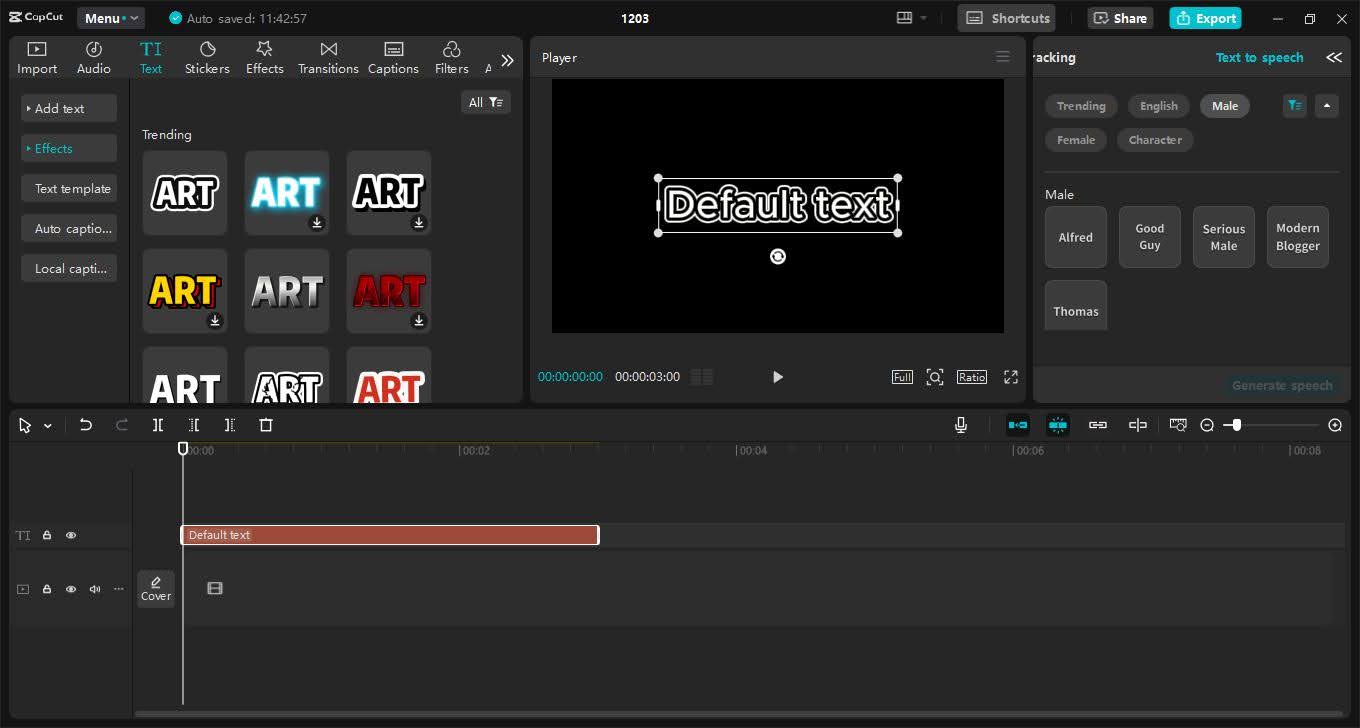

2. User-Friendly Interface for Beginners and Experts

CapCut desktop video editor deems simplicity as one of its essential attributes while, at the same time, offering a professional look. This makes the application helpful as anyone can easily create fluent voiceovers without requiring deep learning. All that is required to do is to paste your script to the provided text box, select your preferred voice and the program will provide you with a natural-sounding narration.

For individuals with complex requirements, CapCut offers options for modifying the voice speed, pitch, and tone appropriately. These options enable you to make the related narration as unique as your video, be it in style, theme, or both.

CapCut

3. Time-Saving Automation

In this aspect, the newer version of CapCut is remarkable, and one cannot help but appreciate how it has optimized the text-to-voice process. When adding voiceovers, there is always the need to trim, adjust volume, and map those clips with corresponding visuals; nevertheless, CapCut does this for you.

This voiceover-creating tool uses artificial intelligence and can help create a ready-to-use voiceover in any given timeline of the video within mere seconds.

Such time-saving optimizations are particularly advantageous for busy creators with limited time to complete their deadlines. From making informative or entertaining tutorials to simple events or daily life clips for sharing on social media, using CapCut means you do not have to bother much about the techniques because the powerful tool will do most of the work for you.

CapCut

4. Cost-Effective Solution for High-Quality Narration

Employing qualified professionals in voiceovers or purchasing recording gear is sometimes costly. CapCut has a better solution that is free and offers high-quality text-to-voice services for your work. This feature is especially valuable for small companies, individual sellers, and educators who want to save money. With CapCut, all these come at a very low cost while delivering high-quality audio that is almost akin to that of a professional narrator.

CapCut

5. Versatility Across Content Types

Unlike other similar software, with CapCut, the text-to-voice feature can be applied to any type of content for your videos. Its versatility makes it a go-to tool for various projects, including:

Social Media Content: Make interesting clips on reels, TikToks, or YouTube shorts with awesome voiceovers.

Educational Videos: Record the smooth flow of narratives in any e-learning program, instructional videos, or manuals.

Marketing Campaigns: Include dynamic and lively voice-overs to commercial bills and media promotion.

Storytelling: Make your creative stories more lively by adding expressive narrations based on a specific theme.

The ability to fit in these varied content types makes it possible to cover the needs of each content creator in the market.

Apart from the superb text-to-voice function, CapCut provides a perfect video background remover that allows you to remove unnecessary backgrounds from clips. Whether you are producing a sophisticated corporate video or fine-tuning an art piece, this tool helps you create visuals as professional as your voiceovers.

CapCut

Conclusion

CapCut desktop video editor is a game-changer for adding professional voiceovers to videos without breaking the bank or dealing with complex tools. With a diverse voice library, user-friendly interface, and advanced AI, it makes text-to-voice editing effortless and accessible.

Whether you’re a creator, business owner, or educator, CapCut empowers you to create polished videos that engage your audience. Its free, high-quality features make it easier than ever to elevate your video production. Try the CapCut desktop video editor today and turn your words into impactful narrations!

For a century, passwords have remained at the heart of digital security, but they're being questioned more and more today. From data breaches to phishing attacks and the simple annoyance of remembering strings of complex characters, it's little wonder that technology experts and companies are finding ways for more secure yet friendlier options. What's driving this death of passwords, and what is taking their place?

The Password Problem Everyone Is Facing

We have all been there. It is very frustrating trying to remember one password you came up with a year ago or trying to come up with one that is strong enough not to get flagged as "too weak." That is quite a hassle, and one hasn't even started on the myriad security risks. Hackers have known the flaws in the old password system for ages. From brute force attacks to cunning phishing schemes, passwords are quickly becoming less secure in current cybersecurity.

According to this research, a whopping 81% of data breaches are due to compromised passwords. The problem is often human error. People recycle the same password across sites or use something like "123456" or "password123," making it amazingly easy for hackers to do the job. Even when people try to be more secure, they write down or put their passwords in places that don't make them safe enough.

But it's not only the hackers. Password fatigue is a thing. As the number of online accounts increases, whether it's to shop, bank, send work emails, or access social media, so does the complexity of remembering all those passwords. And then there's multi-factor authentication. It's a wonderful add-on layer of security, but sometimes, it can just be a pain in the neck.

Now is the Age of Password Replacements

Out of such challenges, a new generation of alternative authentication and replacement for passwords is emerging on the market, and the goal is plain in sight: making digital security seamless, secure, and user-friendly. So, which are the leading contenders displacing passwords, and what do they do?

1. Biometrics: A Step Toward Seamless Security

One of the most exciting developments in password alternatives is biometric authentication. This includes fingerprint scanning, facial recognition, and even iris scans. Your unique physical traits are used to confirm your identity—traits that are nearly impossible to replicate.

Most new smartphones have fingerprint sensors or facial recognition that unlock devices or open applications without needing a password. According to researchers, biometrics are already used in everything from mobile payments to physical access control in offices. Facial recognition is being incorporated into systems at airports, and even banks are looking into adopting biometric verification for secure transactions.

Using biometrics does not take longer and does not necessitate memorizing anything; you just scan your finger and see your phone. You're immediately in. Biometrics are more vital than the conventional username/ password because you're most unlikely to reproduce or simulate someone's face/fingerprint.

2. Passwordless Login with Magic Links

Another innovative approach to password-free logins is using "magic links." This approach has become increasingly popular among websites and apps, which often want to simplify the login process without compromising security.

It works as follows: instead of entering a password, you receive a one-time, time-sensitive link by email or text message. Clicking that link logs you into your account directly without needing to remember any credentials. This is really convenient for those who do not want to bother typing passwords but want to be sure that the person attempting to log in is authorized.

Others think that magic links will be the future of authentication for the next generation. They are quite easy to use, and hackers have limited time before they can misuse them.

3. Hardware Tokens and Security Keys

This has been quite popular with websites and apps that try to make their login processes easy but do not compromise security.

It works this way: instead of entering a password, the user is sent an email or a message with a special time-pressing link. The link automatically logs you in right when you click it, without even asking about the credentials. This is very easy for those who hate punching passwords but don't like strangers logging into accounts from anywhere.

4. Behavioral Biometrics and AI

Another emerging area is behavioral biometrics, which relates to how you type, hold your phone, or even walk. Advanced AI algorithms track these unique behaviors to authenticate users.

Behavioral biometrics provide continuous authentication; that is, instead of being authenticated at the login time, your behavior may be analyzed continuously during the session. If it detects anomalies, such as a significant change in typing speed or posture, it will raise suspicion and request further authentication.

This technology is still in its nascent stage but will revolutionize the way people secure their digital lives, making it nearly impossible for someone other than the true owner to access a device or account.

5. The Future of Authentication

As we move away from passwords, it's becoming increasingly evident that there is no one-size-fits-all solution. Rather, a combination of technologies will likely drive the future of authentication. For instance, a user may unlock his or her phone using facial recognition but authenticate a transaction using a hardware key or behavioral biometrics.

Moreover, as privacy concerns grow and the demand for convenient yet secure access is very much in vogue, solutions will eventually change to suit the needs of this new digital age. When the ecosystem matures, the old password will slowly begin to fade into the background

Conclusion

Cyber threats continue to evolve, and so must our methods of authentication. From biometrics and magic links to hardware tokens and behavioral AI, we’re entering a new era of digital security. And with these innovations, we’re improving security and making our digital lives more straightforward and convenient. So, while passwords will likely be with us for some time, their days are numbered. The future of security is fast, seamless, and, above all, secure.

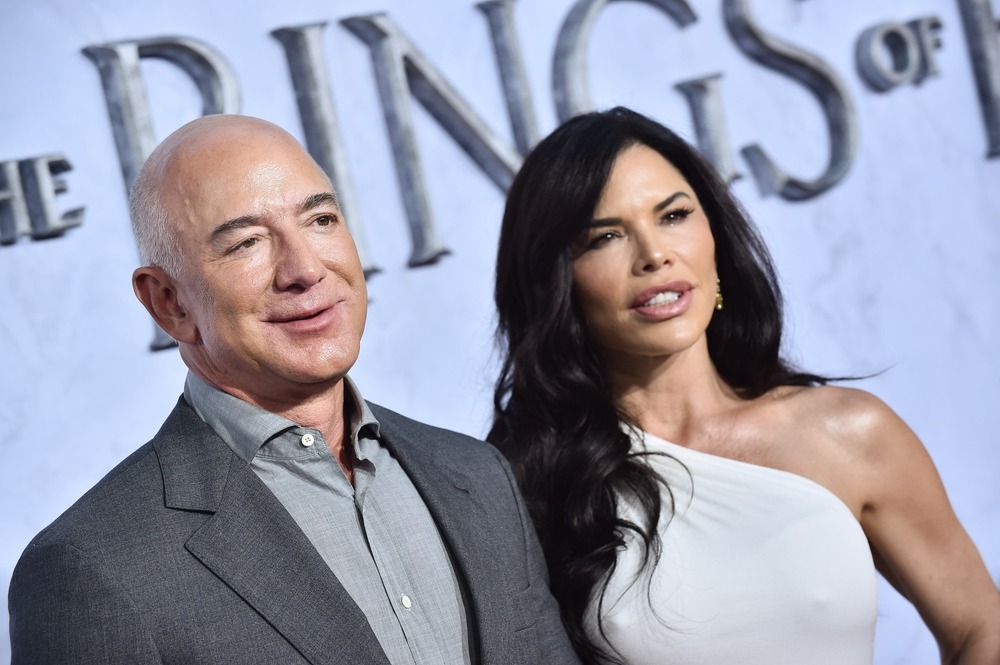

Jeff Bezos: A Visionary Leader With a $226 Billion Net Worth.

What is Jeff Bezos' net worth?

Jeff Bezos is an American entrepreneur, philanthropist, and space enthusiast with a staggering net worth of $226 billion. He made his billions as the founder of Amazon.com and has held various roles, including former CEO and current president and chairman of the board. In July 2017, he became wealthier than Bill Gates for the first time. From October 2017 to January 2021, he was the richest person on the planet without a break. He reclaimed the title of the world's richest individual in March 2024, overtaking Elon Musk in net worth.

Jeff currently holds 55 million shares of Amazon, which is about 12% of all outstanding shares, according to the latest SEC filing. At one point, he had 80 million shares. During his divorce settlement with MacKenzie Bezos in April 2019, he transferred 19.7 million shares to her, valued at $36 billion at that time. This move dropped his net worth from $150 billion to $114 billion for a while. Jeff was also an early investor in Google and has at least $1 billion in shares of Alphabet Inc.

For a good chunk of the 2000s, Jeff wasn't even in the top 10 or 20 richest people in the world. But then, starting in late 2014, Amazon's stock took off. By July 2015, his net worth hit $50 billion, and in less than two years, it had doubled. On July 27, 2017, he surpassed Bill Gates to become the richest person in the world. By September 2018, Amazon's market cap reached $1 trillion, and at that point, he still had 80 million shares, pushing his net worth to a record $170 billion.

Interesting Facts

He left his finance job in 1994 to start an online bookstore.

While driving cross-country, he came up with the Amazon business plan.

When Amazon went public in 1998, his net worth soared past $12 billion. However, after the dotcom bubble burst, it dropped to $2 billion.

By 2015, his net worth hit over $50 billion for the first time.

In 2018, it crossed the $100 billion mark.

He also invested in Google before its IPO, which is now worth about $1 billion.

When he and MacKenzie announced their split, his net worth was $136 billion.

MacKenzie got 20 million Amazon shares and became the richest woman in the world.

If they had stayed together, Jeff's net worth could have easily exceeded $250 billion.

He owns The Washington Post and has $300 million in property in Beverly Hills, along with $60 million in Washington.

To date, he has sold at least $70 billion worth of Amazon shares and uses $1 billion a year to support his space venture, Blue Origin.

By July 2021, his net worth reached $211 billion.

RELATED: Elon Musk's Net Worth Rockets to an Astronomical $348 Billion in 2024.

Was Jeff Bezos Ever the Richest Person of All Time?

When you look at Jeff's highest net worth of $200 billion and stack it up against our list of the richest people ever, adjusted for inflation, he doesn't even crack the top 10. That $200 billion would actually place him as the 11th biggest fortune ever held by one person (after adjusting for inflation). Just to give you some perspective, when oil magnate John D. Rockefeller passed away, his worth was around $340 billion when you factor in inflation.

Could Jeff Bezos Become a Trillionaire?

It’s all about possibilities! But aiming for trillionaire status seems pretty ambitious if he’s only counting on his Amazon stocks. With 12% of Amazon’s shares, Jeff’s net worth is around $120 billion for every $1 trillion in market cap. So, to hit that billionaire mark just from his Amazon shares, the company would have to reach a market cap of over $8.3 trillion.

Early Life

Jeff Bezos was born on January 12, 1964, in Albuquerque, New Mexico. His mom was just 17 when she had him, and his dad ran a bike shop. After a while, she divorced Jeff's biological father and married a Cuban immigrant named Miguel Bezos when Jeff was four. Miguel adopted Jeff, and that’s when Jeff's last name changed from Jorgenson to Bezos.

The family then moved to Houston, where Miguel found work as an engineer at Exxon. They also got to be closer to Jeff's grandparents, who owned a cattle ranch south of San Antonio. Interestingly, Jeff's grandmother, Mattie Louise Gise, was a first cousin of country music star George Strait.

As a kid in Texas, Bezos turned his parents' garage into a lab for his science experiments. He spent his summers working on his grandparents' ranch, which he later credited for shaping his strong work ethic. Eventually, he bought the ranch and grew it from 25,000 to 300,000 acres.

The family relocated to Miami just as Jeff was starting high school. During his high school years, he took on a job as a short-order cook at McDonald's. He excelled academically, becoming the valedictorian and a National Merit Scholar. In his speech as valedictorian, he shared his vision of humanity eventually colonizing space.

Jeff went on to attend Princeton University, initially aiming to study physics, but his passion for computers led him to change his focus. He graduated summa cum laude with a 4.2 GPA and was inducted into Phi Beta Kappa, earning a Bachelor of Science in computer science and electrical engineering.

After college, Jeff joined a financial tech company called Fitel. He later moved into the banking sector, securing a product management role at Bankers Trust. In 1990, he became a financial analyst at D. E. Shaw & Co., a newly established hedge fund that aimed to leverage mathematical modeling for significant market gains.

Jeff was with D.E. Shaw until 1994, and by then, he had climbed the ranks to become the fourth senior vice president of the company. He was just 30 years old at that time.

Amazon

A year before, Jeff got really interested in the early days of the internet. He thought about selling stuff online and decided to go with books. While driving from New York to Seattle, he came up with Amazon's business plan. He officially started the company in 1994, kicking things off from his garage.

Other Accomplishments

In 2008, Bezos was awarded an honorary doctorate in Science and Technology from Carnegie Mellon University. Earlier, in 1999, he was recognized as Time magazine's Person of the Year. Then in 2000, he launched Blue Origin, a startup focused on human spaceflight, driven by his love for space exploration. Blue Origin's vision includes creating space hotels, amusement parks, and even colonies or small cities for millions of people orbiting Earth.

The company kept a low profile for a few years, only coming to light in 2006 when it bought a large piece of land in west Texas for a launch and testing site. In 2013, Bezos was chatting about commercial spaceflight with Richard Branson, the billionaire behind Virgin Group, and that same year, he also acquired The Washington Post.

Real Estate And Other Toys

For about thirty years, Jeff called Seattle, Washington home. In November 2023, he shared his decision to relocate to Miami full-time. Just two months prior, he dropped a whopping $150 million on two side-by-side properties on a private island known as Indian Creek Village, often referred to as the "Billionaire Bunker." The buzz is that he plans to demolish both places to build a huge new mansion.

By April 2024, it came to light that Jeff had snagged a third mansion on Indian Creek, paying $90 million for a six-bedroom house where he intends to stay while he tears down the other two to create a super estate.

Back in 2007, Jeff and MacKenzie bought a mansion on two prime acres in Beverly Hills for $24.5 million. Then in 2018, they added the neighboring home for $12.9 million. Following their divorce in 2019, MacKenzie received the now-combined property. In August 2022, she announced that she had donated the two homes to the California Community Foundation, with the combined value estimated at around $55 million at the time of the donation.

On February 12, 2020, it came to light that Jeff dropped a whopping $255 million on two properties in Beverly Hills. The first one, the Jack L. Warner estate, set him back $165 million. This stunning estate sprawls over 10 beautiful acres right in the heart of Beverly Hills and boasts a main house that’s 13,600 square feet. The previous owner was entertainment giant David Geffen, who snagged it back in 1990 for just $47.5 million.

The second property Jeff was said to have acquired in February 2020 was a 120-acre vacant hilltop known as Enchanted Hill. This land was sold by the estate of the late Microsoft co-founder Paul Allen, who bought it in 1997 for $20 million. While the place is mostly covered in weeds, it does feature a 1.5-mile driveway and a nicely kept bluff at the top. However, just a month after the news broke, the deal fell through. So, in the end, Jeff's big real estate move in February 2020 was just the $165 million Jack L. Warner estate.

Other real estate assets:

A $23 million mansion in Washington D.C. was bought in 2018.

It used to be a museum and includes two buildings with a total of 27,000 square feet of living space.

There are also 300,000 acres in Texas, featuring several ranches, plus another 100,000 acres scattered across the country.

In Manhattan, there are three units at 25 Central Park West.

Additionally, there's a $10 million 5-acre property in Medina, Washington, purchased in 1999, and a $50 million mansion right next door in Medina, acquired in 2005.

Net Worth Details And History

Over the past two decades since Amazon went public, Bezos has offloaded at least $70 billion in shares. He typically sells around $1 billion worth of stock each year as part of a planned selling strategy.

When Amazon first hit the market, its market cap was just $300 million. Jeff held a 40% stake in the company, which put his net worth at about $120 million (before taxes). Within a year, he had skyrocketed to a billion-dollar net worth. During the height of the dotcom boom, his wealth peaked at over $10 billion. However, after the bubble burst, Amazon's stock plummeted to a low of $5 per share in October 2001, and Jeff's net worth dropped to between $1 and $2 billion.

If you had the foresight to invest $10,000 in Amazon shares back in October 2001, you'd be sitting on more than $15 million today, not even counting any dividends.

RELATED: Cristiano Ronaldo's Net Worth: A Deep Dive Into His $800 Million Fortune.

Net Worth Milestones

In May 1997, the company kicked off with a bang at $120 million on its IPO day. Fast forward to June 1998, and it hit the $1 billion mark for the first time. By June 1999, that number skyrocketed to $10 billion. Then in July 2015, it reached a whopping $50 billion. Come January 2018, it doubled to $100 billion, and by July 2018, it was at $150 billion. Just a couple of months later, in September 2018, it climbed to $170 billion.

In January 2019, Jeff announced he was divorcing MacKenzie after 25 years, which was bound to shake up his $150 billion fortune. On April 4, 2019, they shared that they had come to a friendly agreement on their divorce, with MacKenzie getting $36 billion in Amazon stock. Jeff kept 75% of his shares and maintained voting control over MacKenzie’s. She wouldn’t own any part of The Washington Post or Jeff's space venture, Blue Origin. The details on how they divided their homes and jets remain a mystery. After the announcement, Jeff's net worth dropped to $114 billion.

By March 9, 2020, it was at $111 billion, then jumped to $172 billion by July 1, 2020. Just days later, on July 9, it soared to $190 billion, and by August 26, 2020, it hit $202 billion. However, by December 2022, it had fallen to $117 billion, and in January 2023, it was down to $107 billion.

Jeff hit billionaire status in just three years after starting out in 1995. It took him two decades to reach $50 billion, but he managed to rack up another $50 billion in just 2.5 years, bringing his total to $100 billion. Then, in a mere seven months, he added another $50 billion, pushing his total to $150 billion. But just like that, he lost $36 billion with a single decision.

Jeff Bezos Net Worth Over Time

June 1997 - $150 million

June 1998 - $1 billion

June 1999 - $10 billion

March 2000 - $6 billion

December 2000 - $2 billion

September 2001 - $1.5 billion

September 2003 - $2.5 billion

September 2004 - $5.1 billion

September 2005 - $4.1 billion

September 2006 - $4.3 billion

September 2007 - $8.7 billion

September 2008 - $8.2 billion

September 2009 - $6.8 billion

September 2010 - $12.6 billion

September 2011 - $18 billion

December 2012 - $23.2 billion

October 2013 - $29 billion

December 2014 - $30.5 billion

July 2015 - $50 billion

October 2016 - $45 billion

December 2017 - $73 billion

July 2018 - $150 billion

September 2018 - $170 billion

April 2019 - $114 billion

July 2020 - $190 billion

July 2021 - $213 billion

November 2022 - $117 billion

November 2023 - $170 billion

May 2024 - $208 billion

Jeff Bezos exemplifies entrepreneurial brilliance and visionary leadership. From starting Amazon in a garage to building it into one of the world's most valuable companies, his journey is a testament to innovation and resilience. Bezos' ventures extend beyond retail, encompassing space exploration with Blue Origin, media with The Washington Post, and significant philanthropic initiatives.

His strategic decisions have redefined e-commerce, cloud computing, and logistics globally. Despite setbacks, his ability to adapt and focus on long-term goals underscores his remarkable success. Bezos inspires by demonstrating how audacious dreams, backed by relentless effort, can reshape industries and push humanity toward new frontiers.

Intel's Stock Soars 7% After Strong Earnings Report

Intel Corporation's stock experienced a significant surge of 7% in after-hours trading on Thursday, following the chipmaker's impressive earnings announcement that not only exceeded market expectations but also provided a quarterly forecast that surpassed analyst predictions.

Performance Highlights

For the fiscal third quarter ending September 28, Intel reported adjusted earnings per share of 17 cents, contrasting sharply with an anticipated loss of 2 cents per share, according to consensus from LSEG. The company's revenue reached $13.28 billion, exceeding the expected $13.02 billion. However, it’s important to note that Intel saw a 6% decline in revenue year-over-year.

The company reported a staggering net loss of $16.99 billion, or $3.88 per share, compared to a net profit of $310 million, or 7 cents per share, during the same period last year. As part of its ongoing cost-cutting strategy, Intel recorded $2.8 billion in restructuring expenses this quarter, alongside $15.9 billion in impairment charges linked to accelerated depreciation of manufacturing assets and goodwill impairment in its Mobileye division.

Major Restructuring Efforts

CEO Pat Gelsinger emphasized during a conference call with analysts that Intel is undergoing one of the most significant restructuring efforts since its founding in 1968. On October 28, Intel's audit and finance committee approved measures aimed at cost and capital reduction, which include a drastic workforce reduction of 16,500 employees and a decrease in its real estate holdings. These job cuts were initially announced in August, with the restructuring expected to be completed by the fourth quarter of 2025.

Intel has faced considerable challenges in recent years, struggling to maintain market share in its core sectors while navigating the complexities of entering the burgeoning artificial intelligence market. To adapt, Intel announced plans to transform its foundry business into an independent subsidiary, aiming to attract external funding opportunities.

Market Context and Strategic Moves

Intel's recent performance comes amid a broader industry context where the company is reportedly seeking the assistance of advisors to counter the influence of activist investors. In a notable move, Qualcomm approached Intel regarding a potential acquisition in late September, underscoring the shifting dynamics within the tech sector.

The Client Computing Group, responsible for PC chip sales, generated $7.33 billion in revenue for the fiscal third quarter, reflecting a decline of approximately 7% compared to the previous year and falling short of the $7.39 billion consensus forecast. Customers have been reducing inventory levels following previous supply shortages, a trend that CFO Dave Zinsner noted is expected to continue through the first half of the coming year.

On a more positive note, the Data Center and AI segment generated $3.35 billion in revenue, marking an increase of about 9% and exceeding the $3.17 billion consensus estimate. Intel projected adjusted earnings of 12 cents per share for the fiscal third quarter, with revenue anticipated to fall between $13.3 billion and $14.3 billion—outpacing analyst expectations for adjusted earnings of 8 cents per share and revenue of $13.66 billion.

During the quarter, Intel also unveiled the Xeon 6 server processors and Gaudi AI accelerators, although the adoption of Gaudi has been slower than anticipated, prompting Gelsinger to adjust the revenue target for the product to $500 million for 2024.

A Year of Challenges

As of Thursday's close, Intel's shares had plummeted by approximately 57% in 2024, starkly contrasting with a 20% increase in the S&P 500 index. The road ahead remains fraught with challenges, but with a renewed focus on restructuring and strategic shifts, Intel aims to navigate its way back to profitability and regain investor confidence.

Disclaimer

The information provided in Finance Monthly is for informational purposes only and should not be construed as investment advice. All content, including articles, interviews, and analysis, reflects the opinions of the authors and does not necessarily represent the views of Finance Monthly.

Investing in financial markets involves risks, including the loss of principal. Past performance is not indicative of future results, and there is no guarantee that any investment strategy will be successful. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Finance Monthly is not responsible for any losses or damages arising from reliance on the information contained herein. By accessing this publication, you acknowledge and accept these terms.

As of early 2024, iOS holds a dominant 60.77% share of the U.S. mobile market, far ahead of Android's 38.81% (Backlinko). This makes iOS app development crucial for businesses targeting a large and active audience.

In this post, we’ll talk about…money, the biggest driver in the development process. We’ll explore how much it costs to make an app from Purrweb’s perspective, but these estimates will either be relevant for other development companies.

What are the peculiarities of iOS app development?

iOS app development has its own set of unique characteristics compared to Android. What makes it stand out?

App Store only

The only place where iOS apps may be distributed is through Apple's App Store. No third-party stores, no APKs—developers have to abide by Apple's rules at all times. These regulations can be strict; before an app is authorized for distribution, it must pass rigorous evaluations and frequently go through many changes.

Limited device range

Apple’s consistent hardware lineup simplifies development. iOS has fewer screen sizes and resolutions to support than the wide variety of Android devices. Because of the simplified testing and optimization process, developers are free to concentrate on creating a polished application rather than worrying about unforeseen problems resulting from subtle hardware variances.

Languages

Additionally, Swift and Objective-C are iOS-specific programming languages. Specifically, Swift is designed to be current and effective, allowing developers to create reliable, high-performing programs.

Enhanced security

Privacy and security come first. Because of Apple's stringent policies on user data, all apps are required to include strong security features, including data encryption and permissions management. The fundamental design of iOS apps upholds this commitment to privacy, guaranteeing that user data is always secure.

How to build an app for iOS

Building an iOS app involves a series of decisions and steps, each of which can influence the final app development costs and development timeline. Here’s a structured approach:

Define your scope and platform needs

Decide if you need an app exclusively for iOS or if you plan to develop for Android as well.

Cross-platform frameworks allow you to build a single codebase for both platforms, which can save money and time, but native development guarantees the greatest performance and user experience.

Work on UI/UX

iOS users have very high expectations for design and usability. Moreover, the design must be adhere to (HIG).

Develop and test

Use Apple's Xcode integrated development environment (IDE) for project management, code authoring, and app building.

Extensive testing is essential. To find and fix issues, use physical devices and simulations.

Prepare for App Store submission

Ensure your app complies with all App Store Review Guidelines. This includes content restrictions, user interface standards, and privacy policies. We add different screenshot and keywords to create a list.

Submit to the App Store

Use Xcode or App Store Connect to submit your app for review. Be prepared for multiple review rounds, as Apple may request changes to meet their guidelines.

Post-launch support and updates

Even after release, you should allocate your resources on maintaining and refining the app.

How much money do we spend to build an app?

We spend on various components such as:

Development team costs

| Cost Category | Details | Cost Range |

| Freelancers | Rates depend on experience and location. Suitable for small projects or startups. | $25 - $150 per hour |

| In-house team | Provides greater control but involves higher costs, including salaries, benefits, and infrastructure. | $5K - $25K per month |

| Outsourcing to agencies | Ideal for complex projects with a need for expertise. Costs vary based on project scope and agency reputation. | $20K - $150K+ |

2. App complexity

Most of the apps have minimal functionality and their cost may be between $10K and $30K.

It has database integration, API interactions, and user authentication typically costs between $30K and $100K.

But now, apps that have advanced features such as real-time data sync, custom animations, AI integration, or complex back-end requirements can cost more than $100k.

3. Design costs

Mostly UI/UC design cost between $50k to 30k. It depends on the number of design and screend complexity. If you are budget limited, consider simple UI/UX without complex animations.

4. Backend development

Creating a backend to handle user data, authentication, and other critical features typically costs between $10K and $50K. Third-party services, like analytics tools, social network logins, or payment gateways, can bump up the price by an additional $2K to $10K.

5. App Store costs

Apple’s developer license is $99 per year for individuals. For enterprises, the cost is $299. Additionally, keep in mind that Apple takes a 15% to 30% fee on all in-app purchases and premium software downloads.

6. Marketing and launch costs

Landing pages, press releases, and social media campaigns generally range from $1K to $10K. Of course, marketing is not an obligatory and rigid factor. For example, MVP apps rarely have extensive marketing.

7. Launch costs

App Store optimization costs anything from $1K to $5K, depending on how visible you want your app to be.

8. Maintenance and updates

After launch, bug fixes and small upgrades may run you anything from $1K to $10K a year. Depending on their complexity, adding new features based on user feedback can cost anywhere between $5K and $50K.

How much does it cost to develop an app from Purrweb?

The table below provides approximate pricing for an average project, giving you a general idea of the budget range to consider.

| Stage | Estimated cost | Description |

| Project analysis | $1K | Initial research, feature prioritization. |

| UI/UX design | $5,400 | Wireframes, design concepts, full app design. |

| App development | $36K - $40,500 | Coding and feature implementation. |

| QA testing | $5,400 - $6K | Bug identification and resolution. |

| Project Management | $3,950 - $4,100 | Coordination and oversight throughout the project. |

| App Store submission | $99-$299 | The cost of developer license. |

| Marketing | $1-3K | Depends on the client’s budget and needs, is not strictly regulated. |

| Total cost of app development | $60K+ | Basic functionality app, 4 months development time. |

Of course, this is just an estimate. The actual cost for building an app can vary greatly depending on its specific details. As each app is unique, it's essential to discuss your requirements with a development company and get an accurate quote.

The intersection of art and technology is creating exciting opportunities for financial growth among artists. Leveraging digital tools, modern platforms, and innovative techniques, you can elevate your creative practice while expanding your revenue streams.

Whether you're an established artist or just starting out, embracing technological advancements can transform how you create, market, and sell your work.

Virtual reality galleries, crowdfunding campaigns, social media marketing, digital production tools, and online marketplaces are just a few ways that tech-savvy artists are finding new paths to success.

Let's explore how these innovations can help you boost your career financially.

5 Ways Artists Leverage Technology for Financial Growth

1. Online Marketplaces

Online marketplaces have transformed the way artists sell their work. Sites like Etsy, Society6, and Redbubble offer platforms where you can showcase your art to a global audience.

These websites handle much of the logistical hassle - like payment processing and shipping - allowing you to focus on creating. By setting up an online shop, you not only gain exposure but also have the flexibility to manage your inventory and pricing strategies.

Engaging with customers through reviews and personalized messages builds community and fosters repeat buyers.

Additionally, these platforms often provide valuable analytics that help you understand market trends and improve your sales techniques over time.

2. Digital Music Production

Digital music production has revolutionized how musicians create and distribute their work. With affordable and user-friendly software, even independent artists can produce high-quality tracks from the comfort of their homes. Tools such as digital audio workstations (DAWs) have made recording, editing, and mixing more accessible than ever.

Additionally, advanced features like autotune and effects libraries help refine your sound to professional standards. Digital music mastering is simple with apps like Mixea, allowing you to perfect your tracks without needing an expensive studio setup.

This technological advancement empowers musicians to take full control of their creative process while also opening up new avenues for revenue generation.

3. Virtual Reality Galleries

Virtual reality (VR) galleries are changing the landscape for art exhibitions. With VR technology, you can create immersive, 3D gallery experiences that allow potential buyers to explore your artwork from the comfort of their homes.

This not only saves on physical space and travel costs but also broadens your reach to a global audience. When you offer high-definition views and interactive features, VR galleries provide an engaging experience that traditional online photos cannot match.

Artists can host virtual openings, complete with live chats and guided tours, making it easier to connect with collectors in real-time. This innovative approach is proving to be a game-changer in how art is marketed and sold.

4. Crowdfunding Campaigns

Crowdfunding campaigns have become a powerful tool for artists looking to fund their projects. Platforms like Kickstarter and Netcapital allow you to pitch your ideas directly to backers.

This approach not only democratizes the funding process but also helps build a dedicated community around your work. If you offer exclusive rewards such as limited edition prints, behind-the-scenes content, or personalized experiences, you can incentivize support and engage with your audience on a deeper level.

Successful campaigns provide essential financial backing while maintaining creative control. Additionally, crowdfunding introduces your art to new audiences who may become lifelong fans.

5. Social Media Marketing

Social media marketing has become indispensable for artists seeking to reach wider audiences. Platforms like Instagram, TikTok, and Facebook offer unprecedented opportunities for showcasing your work, engaging with fans, and driving sales.

By sharing regular updates on your creative process, upcoming projects, or finished pieces, you can build a dedicated following. Engaging content such as stories, live sessions, and behind-the-scenes glimpses creates a personal connection with your audience.

Utilizing hashtags and collaborations with other artists or influencers can further expand your visibility. Effective social media strategies not only enhance brand recognition but also direct potential buyers to your online stores or galleries.

Technology Can Be An Artist’s Best Friend

Embracing technology can unlock new doors for your artistic journey, offering endless possibilities for growth and financial success. Don’t hesitate to explore these innovative tools and platforms, integrating them into your creative process.

Start experimenting with online marketplaces, virtual galleries, crowdfunding, social media marketing, and digital production today. Each step you take opens up more opportunities to connect with audiences worldwide and monetize your talents in fresh ways.

7 Simple ways you can make money now

In today’s fast-paced world, finding easy ways to make some extra cash can be a game-changer. More people are looking for ways to make extra money, at the beginning of 2024 in the UK 1 in 4 adults had a side hustle, small business or a secondary job alongside their full-time careers. In the US more than a third of adults — and nearly half of millennials and Gen Z have a second stream of income in 2024.

Whether you need to pay off bills, save for a vacation, or just have some fun money, there are numerous avenues available that anyone can tap into. Here are 7 simple ways you can make money now!

Financial technology is becoming increasingly crucial to modern life. It’s what drives the movement of digital money, allowing consumers to buy goods remotely and greasing the wheels of contemporary commerce. But it also sits in a precarious position.

Fintech companies like Flutterwave, Africa’s most valuable tech startup, must balance the needs of data security against the opportunity costs of growing larger and developing new services. And they must do it in a rapidly changing environment.

“Our growth has been customer-defined,” Flutterwave CEO and founder Olugbenga “GB” Agboola said on “The Flip” podcast. “Our expansion is always customer-driven. Where does the customer want us to be? We listen to customers a lot in Flutterwave. We have an extreme customer obsession in Flutterwave when it comes to what our customer wants and how to deliver to the customer.”

What Does Fintech Do?

People often fall into one of two camps: the kind who never think about money, and the kind who always think about the bottom line. But even those who obsess over their bank balances don’t often consider what actually happens when they make a purchase or transfer money from one account to another.

Behind every swipe of a credit card, click of a “checkout now” button, and direct deposit, millions of micro-actions are taking place. Fintech is what communicates between banks, merchants, lending institutions, peer-to-peer transfer apps, and more.

Financial technology began as a way to improve the efficiency of the pen-and-ink ledgers of days past. But it’s become much more than a digital balance sheet. Today, fintech powers automated investment technology, assists nonprofits with fundraising operations, revolutionizes how credit card companies do business, and has spurred new industries like microloans.

In short, it’s how the modern economy does business and how it keeps score.

Nearly every modern financial action, from mortgages to day care, is managed by financial technology.

And the revolution has just begun.

How Flutterwave Grew

As one of the fintech sector’s most exciting startups, Flutterwave has played a crucial role in the modern financial economy. The 8-year-old, Flutterwave serves enterprise clients like Microsoft and Uber, as well as individuals seeking to easily pay for goods and services, send money to friends and family, and cover out-of-country tuition costs.

By serving both multinationals and everyday people, the company has become a service provider on both ends of the modern economy, giving it a unique perspective into how today’s business functions.

Flutterwave is also unique in that it was comfortable using its understanding of the marketplace to dictate its growth, said Agboola.

“We helped Uber to scale across Africa and we follow them into every market that they were going to go into. So, our expansion and growth story can be linked to our customer requirements, and it can also be linked to our philosophy about making payments simpler across Africa and simplifying payments for endless possibilities,” he said on “The Flip.”

“For us as a company, it’s really just about: How do we make sure our customers can scale on our platform? How do we make sure our customers can go to a new country in Africa and all they have to do is just flip a switch, literally, on our dashboard and they can just go live in their new market?” he added. “Our expansion is always customer-driven. Where does the customer want us to be?”

How Flutterwave Prepares for the Future of Fintech

The focus on service — not growth — is what ultimately allowed Flutterwave to prosper amid a sea of rival service providers. Through Agboola’s leadership and partnerships with influential market leaders like Uber, the company navigated its way from promising startup to a Series D fundraise that resulted in a valuation north of $3 billion.

Companies don’t get to that level by being lucky. It takes a certain amount of skill at understanding the present and predicting how the currents of today will shape the waves of the future.

For Flutterwave, the future of fintech will result in a more integrated, interconnected world. From the beginning, Agboola has claimed that his company’s goal was to connect the whole of Africa. Following that logic, it’s clear the future of fintech is complete market saturation, allowing every person across the globe access to the worldwide economy through their phones, laptops, or computers.

But as they become ubiquitous, fintech platforms will change. Fintech could become more convenient for users, integrating directly into nonfinancial software. Social media users may be able to pay for products from content creators and advertisers directly through their favourite apps, and retail apps feature new services, such as buy now, pay later options at checkout.

There might also be a revolution in how traditional financial institutions, like banks and lenders, serve consumers. Digital payments and banking services could make all kinds of big-ticket purchases, like mortgages and car loans, simpler and faster for consumers.

The wealth of new data may lead to software that delivers personalized financial advice to consumers, allowing lenders or artificial intelligence to steer individuals toward smart investment strategies, better ways to save for education, and more.

All of these new ideas are exciting, but none more so than what Flutterwave continues to train its focus on: the democratization of modern finance.

As developing countries move into the digital world, their economies will undergo a tectonic shift. By empowering a new segment of the market, Flutterwave will help create the next generation of marketplaces by helping to provide fintech services to entire niches that have been excluded from the modern economy for decades.

Transforming small communities can have profound downstream effects that will ripple outward to the entire world economy, according to Agboola.

“We are an enabler,” he said. “We may not go directly to help reduce poverty, but we are going to enable businesses that help to reduce poverty.”

Making money online

Survey Junkie has over 20 million members using their services to make money easily online. As one of the most well-known platforms for earning money through surveys, you can start today and join the millions earning extra.

Making money online is becoming increasingly popular as more people look for easy ways to increase their monthly income around their current day-to-day jobs. Completing surveys is one way to do this and Survey Junkie is one platform which offers you an accessible way to do this.

What is Survey Junkie?

Survey junkie is a user-friendly platform so that anyone can start making money online by completing surveys. Brands want to hear from you, you will be giving your opinion on products, services, and more so that they receive consumer insights.

Once you create an account you will have surveys that match your preferences in interests, length of time and points earned. When you earn enough points, you can convert them into real money either through PayPal or e-Gift cards that you can use.

How to get started on Survey Junkie

Sign up to Survey Junkie if you are 18 years old or over so you can start claiming rewards.

- You will be asked several profile questions so that the platform can then match surveys to your relevant interests and background. This way the insights are accurate and will likely be something you are interested in.

- You can decide how you participate, whether that is through sharing your opinions via surveys or focus groups for rewards. Alternatively, you can sign up for surf to earn which will automatically share digital browsing behaviors. This will track the websites you use, Ads you see, shopping terms, content you engage with online and more. You will be rewarded when you allow digital sharing on your device.

How you can earn money

The more you participate, the more you can earn. Survey Junkie cannot take the place of a full-time job, but it will give you some extra money if you are saving for something, or just need a bit extra.

If you complete 3 surveys a day in your spare time you could make $40 a month on average.

Each survey you complete you will earn points; one point is equal to 1 cent on average. So, it may take a while to build up your earnings.

How to redeem your earnings

Once you have earned some points you can redeem them through the platform which uses PayPal if you want money.

You can also redeem them in e-Gift cards for places such as, Amazon, Walmart, Target and more. This could help you build up a pot of money for your shopping.

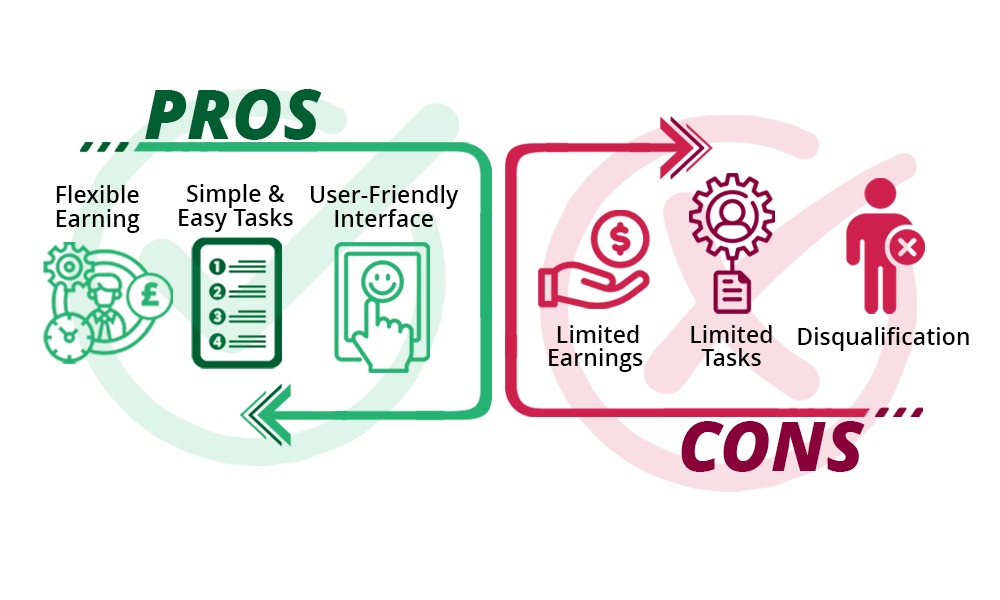

Pros and Cons of Using Survey Junkie

Pros -

- Flexible Earning – Survey Junkie will offer a highly flexible way to make extra money, allowing you to choose when, how often and which surveys to complete. This gives you full control of your schedule making it compatible with any other commitments you have.

- Simple and easy tasks – The surveys are straightforward and easy to complete. You’ll be earning money based on your opinions on simple tasks which don’t require any skills. This means you won’t have to set aside much time and you can do it after a hard day at work.

- User-friendly interface – Survey Junkie is praised by its members for its easy-to-navigate interface. Even those with little tech experience find it accessible.

Cons -

- Limited earnings - You do not earn much per survey so it will take a while to build up any significant earnings through this method.

- Limited number of tasks - After your account matures, users report that the number of available surveys also declines. This means you will have less options to make money.

- Disqualification - Users also report being disqualified often and unable to complete surveys. This could be because you don’t match the target audience, or the platform determined that answers were not accurate and honest. This can be frustrating after completing long surveys and only be rewarded with a couple of points for trying but not the full amount you expected.

- Redeeming rewards - It can be tricky to redeem your winnings. You can take out the full balance in cash through PayPal, however if you have 2700 points you will be given a $25 Gift card for your chosen store and have left over points on your account. Gift Cards will only be given in certain increments so you will have to work this out beforehand to get what you want.

Tips to Maximize your earnings

- Completing your profile questions so you can have relevant surveys given to you.

- Logging in to your account daily to check for new surveys.

- Sign up to surf to earn if you are happy for your data to be shared as you can win more points this way.

- Referring to friends can often win both of you rewards.

What You Need to Know and How to Manage Costs

The cost of living has affected all areas including phone bills, leaving many consumers questioning what they can do to manage these rising costs. Understanding why phone bills are increasing, how much you should be paying, and what steps you can take to manage your expenses can help you stay on top of your finances.

Are Phone Bills Rising?

Most major UK mobile networks increase their prices once a year, typically attaching these rises to inflation indicators such as the Retail Price Index (RPI) or the Consumer Price Index (CPI).

On top of this, networks often add an additional 3-4% to cover the increasing costs of upgrades, maintenance, and service delivery.

For example, a price increase linked to RPI, which in the UK stood at around 8-10% in 2023, would see a considerable hike in phone bills. If your phone bill was £30 a month, a 10% RPI increase plus a 3% network addition could result in your monthly cost rising by almost £4.

This may seem like a small change, but it amounts to nearly £50 more over the course of a year.

Moreover, the potential merger between Vodafone and Three could have further implications for mobile users. If this deal goes through, it could reduce competition, leading to even higher prices for millions of customers as the newly-merged unit may raise prices to consolidate its market position. This would add pressure on consumers already struggling with higher costs.

How Much Should You Be Paying?

One of the most important things you can do to manage your mobile bill is to assess whether you're paying a fair price for your service. According to Ofcom, the UK's communications regulator, the average cost for a basic mobile phone contract that includes 100 minutes of calls, 75 text messages, and 5GB of data is £11.51 per month, excluding the cost of the handset. A contract ideal for those who don’t use their mobile phone too often.

On the other hand, heavier users—those who might need 500 minutes of calls, 150 SMS, and 15GB of data—will see their average bill rise to £15.53 per month. While these figures represent the typical costs for consumers, it’s essential to remember that additional charges can apply, especially if you exceed your contract limits or need extra services like international calling.

In addition to understanding average costs, it’s important to recognise how much you're paying for the handset itself. If your phone is included in your contract, you may be paying significantly more than the cost of service alone. Often, users continue paying the same monthly amount even after the handset cost is fully paid off, which means they end up overpaying. If you're in this situation, it may be worth switching to a SIM-only deal.

What To Do When Your Mobile Phone Bill Rises?

When your receive notice that your phone bill is increasing your don’t have to accept this, you can take these steps to try and lower the price.

- Negotiate with your provider: Many mobile networks are willing to offer discounts or alternative plans if you threaten to leave for a competitor. Often, a simple call to your provider's customer service team can result in better deals, especially if you mention cheaper options from other companies.

- Switch to a SIM-only deal: If you’ve finished paying off your phone, switching to a SIM-only plan can save you a significant amount of money each month. These plans typically cost much less than those that include a handset, and you’ll have the freedom to change providers more easily if necessary.

- Monitor your usage: Review your phone usage patterns. Are you consistently going over your data limit? Are you paying for minutes or texts that you don't use? If so, switching to a plan that better suits your actual usage could reduce your monthly bill.

- Consider alternative providers: Smaller or budget-friendly providers can offer cheaper deals than the major networks. Often, these smaller companies piggyback on larger networks' infrastructure, meaning you get the same coverage at a lower price.

Compare Companies to Find the Cheapest Phone Bills

If your current provider is unwilling to negotiate a better deal, you should start comparing alternatives. Below are examples of three mobile networks in the UK that offer competitive pricing:

- Giffgaff: Offering affordable and flexible SIM-only plans, operating on the O2 network with packages starting as low as £6 per month for light users. They do not have contracts on offer which allows you to change or cancel at any time.

- Tesco Mobile: Using the O2 network, Tesco Mobile offers plans starting at around £7.50 per month for low users. Their "Capped Contracts" feature prevents you from overspending, a handy tool for budget-conscious customers.

- iD Mobile: Operating on the Three network, iD Mobile offers plans from £5 a month, with some of the cheapest SIM-only deals on the market. Their data rollover feature lets you carry over unused data to the next month, saving you from purchasing additional data.

The finance world looks very different than it did just a decade ago. Technology continues disrupting the status quo, customer expectations keep evolving, and innovations happen every day. To thrive in this environment as a finance brand, you need to keep up with the latest marketing strategies if you truly want to rise above your competitors and reach your target audiences.

The good news is that there are a few key strategies that you can use to create standout customer experiences and make your company stand out amongst the ever-growing backdrop of finance brands. From investing in a fintech press release platform to blending physical touchpoints with digital personalization, here are 5 techniques that leading finance brands should have on their radar in 2024. While ambitious, those who start laying the groundwork for these kinds of initiatives now will have a proven roadmap for success.

Specialized Press Release Distribution

Press releases have always been a great way for brands to spread major news and build credibility. However, finding a good return on investment can be difficult for finance-focused when using general press release distribution services. The announcements often get lost in the noise and fail to reach key decision-makers in the finance industry.

To get around this, it’s best to go for a service that gets into the ins and outs of the industry. For instance, FinanceWire is a dedicated finance press release platform that has cultivated relationships with top-tier financial publications to guarantee homepage coverage on sites that matter. This includes outlets like TipRanks, Investing.com, Finbold, and more.

The main perk here is instant visibility amongst key decision-makers in finance. This includes stock analysts, professional traders, advisors, executives...the people that can impact market movement or purchase decisions. Sending newsworthy releases on events like funding news, product launches, partnerships, etc. gets your brand on their radar ASAP.

As you craft press releases, optimize them around keywords that these audiences search for. That way you can ensure maximum visibility for your efforts and boost ROI across your PR campaigns.

Phygital Experience Optimization

The lines between physical and digital banking have blurred. Today, you need an omnichannel approach that provides seamless integration between in-person and online experiences. This blending of the physical and digital worlds is often referred to as "phygital" in marketing speak.

Going phygital with your finance services is key. For instance, if a customer starts an application in your mobile app, they should be able to easily finish it at a physical branch. Pull up their data instantly via device syncing and allow them to securely verify info on your tablets. Install user-friendly self-service kiosks as another transitional endpoint between the digital and physical.

Likewise, what they did at a physical bank should be visible in their digital profile. This phygital integration, where digital connections enhance physical touchpoints, breeds brand loyalty as you make their lives easier. As always, you should be aiming to meet users in their channel of choice. This means offering flexible ways to open new accounts, apply for products, or execute transactions whether in-branch, online, via phone call or through chatbots.

Behind the scenes, consolidate data and document signing digitally to enable this seamless, interconnected experience. Empower employees via anywhere access so they have the 360-degree customer view needed to assist visitors to physical branches. Removing friction through phygital connection should be a priority.

Gamified Financial Literacy Campaigns

One excellent way to generate goodwill is through gamified financial literacy campaigns. These educate your audience about personal finance in an engaging, rewarding way.

For example, you can partner with fintech platforms to create investing simulations using play money. Have contests to see who can build the highest return portfolio that outperforms the market. The top players earn real rewards like gift cards or merchandise.

Or, you could produce a money management mobile game. Make it fun and engaging while teaching skills like budgeting, saving, reducing debt, and building credit. Many of the top fintech brands have some sort of these elements within them, and they can even double down as a compliance box-ticking exercise if you operate in countries such as the UK and US - especially for crypto and blockchain-based services.

Showing that you have taken steps to educate your users and ensure understanding of your products (especially if capital is at risk), is an important element of staying on the right side of regulators.

AI-Powered Predictive Marketing

Artificial intelligence or "AI" is all the rage these days - and many finance brands are wondering how they can harness AI's power. What are some practical applications of AI for marketing? How can it help you engage customers in a more personalized way?

The truth is that AI has massive potential to transform how you promote finance products and services. Specifically, by powering predictive analytics that offers exactly the right recommendation at exactly the right time – automatically.

AI leverages data from your customer relationship management platform (CRM), website, mobile app usage and wherever else you have data sources to identify patterns. Algorithms can determine someone's creditworthiness for a loan. Or assess which new investment product aligns with their risk tolerance based on trading activity.

Deploying this technology through machine learning models gives your system thmarkete ability to get smarter over time. The more data fed in, the better it gets at matching products with people likely to be interested.

This means you can time personalized email campaigns, in-app messages or printed mailers to align with moments when customers will be most receptive. The system handles the heavy lifting. For example, if a customer set up a college savings plan five years ago, your AI could kick start an automated nurturing track when their child turns 16. This prompts them to consider additional ways to save for impending tuition payments.

The beauty is that this level of personalization scales easily across your entire customer base, and it optimizes itself through continual testing and reporting. Pretty soon you have happy customers who feel understood and marketing efforts that pay for themselves in revenue and loyalty.

Micro-Influencer Collaborations and User-Generated Content

In 2024, partnering with personal finance influencers with small but very engaged audiences on social media platforms like Instagram and TikTok will provide an authentic way to promote your banking solutions and products. These "micro-influencers" typically have between 1,000 to 100,000 followers in a specific niche like budgeting, investing, retirement planning, etc.

Identify a handful of relevant micro-influencers in financial verticals you want to be known for. Analyze their follower demographics and engagement metrics to ensure there's alignment with your target customer base. Then reach out to the influencers to collaborate. You can pay them or simply provide complimentary access to your banking tools. In exchange, they will honestly showcase and review your offering to their loyal followers.

You can also encourage user-generated content from your own customers. Prompt them to post testimonials, share their experience onboarding with your mobile app, or demonstrate your budgeting features. With their consent, re-share these posts as social proof. Contests that incentivize user-generated content with prizes or amplification of their post often see great participation. This authentic earned media from real customers goes much further than branded ads alone.

Final Thoughts

Mass market approaches are no longer sufficient as consumers expect hyper-personalized experiences. New technologies allow you to cater to individual interests and behaviours in a scalable way.

Specialized press release distribution puts your message directly in front of fintech influencers and analysts covering your niche. Phygital integration understands each customer's unique journey across channels. Gamification turns education into a rewarding game. AI predictive marketing delivers the right offer at the right time. Micro-influencer collaborations develop authentic connections.

The through line is relevance. When you demonstrate a deep understanding of what specific segments care about, you build trust and loyalty. This leads to more customer lifetime value as people turn to you first for finance solutions.

For some time now, many conversations have been about signatures and how they have changed modern businesses. Now, business organizations can skip the long hours of back and forth, especially when they want documents signed.

People can now conveniently attach signatures to documents and collaborate effectively without unnecessary back-and-forth. Today, they can use an electronic signature generator to draw out their signatures, append their initials, and even insert plain text.

Even with all the good attributes of e-signatures mentioned already, can they truly change the future of work? Keep reading to learn how to digitally sign a PDF and how this simple act can revolutionize business operations and make the customer experience worthwhile.

Improve workflow efficiency

One beautiful way e-signature revolutionizes business operations is that staff members can skip the signing of documents as they electronically sign PDF documents.

Instead of emailing documents to be printed, signed, scanned, and re-sent to appropriate departments, they can quickly sign the documents online using a PDF editor like Lumin and send them to the recipient in a minute.

Workers are more satisfied and productive when they can work on more projects rather than mundane, repetitive ones.

Sending an electronic link allows for lightning-fast document turnaround time, eliminating the need to arrange for in-person signatures or back-and-forth postal delivery.

Speed up negotiations and sales delivery.

Platforms for electronic signatures, such as Lumin, are user-friendly and convenient, even for those without technical expertise.

You do not need to be a tech guru to figure your way around the e-signature tool because the user interface is friendly and suitable for people of all knowledge, no matter how basic your computer knowledge is.

The methods of submitting and receiving signatures are simple and easy to understand. Even though you might not know how to sign a PDF, electronic signatures are as simple as emailing and clicking a few buttons.

Hence, workers and customers can sign whenever they want. Everyone can sign their documents from any internet-enabled device, whether Android, iOS, Windows, Linux, or macOS.

In that same light, the negotiation process has sped up, and salespeople can conveniently close deals without hassles.

Reduce costs

The frustrating part about pen and paper signatures is printing, signing, and faxing or scanning the document to the recipient. It is also expensive, as you need a large amount of paper and costly printer ink due to the need to print and scan the document many times.

Fortunately, the advent of signatures has helped organizations cut costs immensely. They don't need to buy as many office supplies as before. An electronic signature may be appended to a proposal or contract in seconds and returned.

Also, the good part of using the e-signature tool is that you don't need any prior education on how to electronically sign a PDF before you can use the tools. All features on the e-signature generator are self-explanatory.

Increase ROI

Organizations can conveniently increase their return on investment with the right electronic signature generator like Lumin.

Companies that use e-signature systems to sign PDF files may reduce their document handling expenses and focus the saved money on other projects.

Streamlining procedures and enabling almost instantaneous document signing and return reduces expenditures and boosts productivity by speeding up corporate operations.

Bolster data security

Electronic signatures add an extra layer of protection against fraud and illegal alterations because they have built-in encryption, decryption, and an audit trail that shows all the changes made to the document.

Thanks to the built-in authentication and encryption features, using an electronic signature leaves less room for fraud and mistakes.

Countries are also introducing more laws about electronic signatures. With the rise in e-signatures, governments knew that there would be cases where clients would become sceptical about how to sign a PDF file while retaining confidentiality and authenticity. So, the EU created the eIDAS regulation, an electronic identification, authentication, and trust services system, while the ESIGN Act, an electronic signature law, was enacted in the US.

Enhance accuracy and compliance.

An electronic signature generator addresses the compliance aspects of signing a PDF electronically while still retaining its accuracy.

Keeping track of paper documents to ensure compliance might be problematic in the event of an audit. However, ensuring that papers are undamaged and not tampered with is vital to prevent litigation and penalties.

Electronic signature encryption ensures document security and adherence to federal and state regulations as you digitally sign PDF files. Your team can rest easy while gathering signatures on important papers since electronic signatures are legally binding.

Embrace paperless workflows

Often, people wonder how to sign a PDF document. Fortunately, electronic signatures (eSignatures) allow you to expedite processes and improve communication with clients, customers, and workers by allowing signatures on several documents from various individuals.

Businesses that care about the environment have been focused on environmentally friendly practices and going green by moving towards paperless, cloud-based solutions for some time now.

So, a business concerned about the environment can join the bandwagon by adopting an e-signature system that can be used to sign a PDF online.

Electronic signatures help businesses reduce paper, ink, and cumbersome printing and faxing equipment that is challenging to repair and recycle.

Improve customer satisfaction

Sometimes, the big problem of “how to sign a PDF” and get it back to the office in time for processing to be processed in time can be challenging.

However, with an e-signature generator, customers and prospective hires may see how much you value their experience using electronic signatures. Giving customers the option to sign online alleviates the burden of the paperwork that often accompanies these agreements.

Electronic signature fields allow clients to sign papers from any device, whether a mobile phone or a desktop computer. This feature adds another level of efficiency and speeds up the process.

Also, it is easier for businesses to get all of their documentation and proposals reviewed in one location instead of sending them back and forth.

Final words

This article has covered eight ways e-signatures can revolutionize business operations. Electronic signatures are becoming more than a cool new technology; they are a significant shift that improves customer satisfaction, cost-effectiveness, and efficiency in corporate processes.

Also, organizations may reduce their environmental impact and save money on office supplies by eliminating the need for tangible papers, which aligns with sustainable business practices.

E-signatures are an intelligent step towards modernizing corporate processes in a time when digital interactions and remote work are increasingly the norm. By adopting this technology, businesses may improve accuracy, communicate better, and provide consumers and workers with a seamless experience.